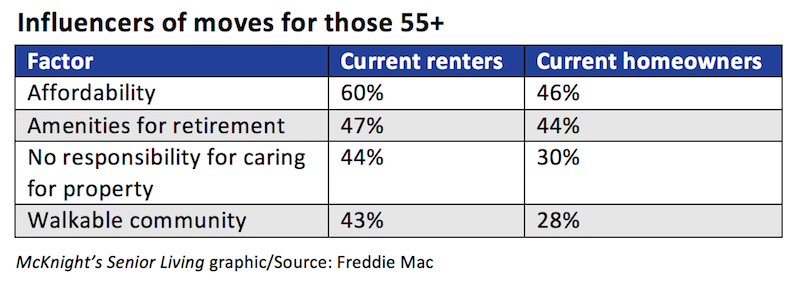

Affordability and amenities will be the top influencers of future moves among renters and homeowners currently aged 55 or more years who responded to the first Freddie Mac 55+ Survey.

Affordability and amenities will be the top influencers of future moves among renters and homeowners currently aged 55 or more years who responded to the first Freddie Mac 55+ Survey.

Renters and homeowners value those factors and others differently, however.

The survey found that although 34% of renters in this age group would prefer to age in place, 17% said they plan to move to a retirement community at some point.

Among 55+ homeowners, the survey found that although 63% said they would prefer to age in place in their current homes, almost 40% said they would prefer to move at least one more time.

Renter preferences

Current renters said that the top “very important” factors that will influence their next move will be:

- affordability (60%);

- amenities needed for retirement (47%);

- no responsibility for caring for the property (44%); and

- location in a walkable community (43%).

Additionally, 31% of 55+ renters said would like to relocate to a different neighborhood in the same city, 24% said they wanted to move to a different state, 23% said they would like to move to a different property in their current neighborhood, and 18% said they would like to move to a different city in the same state.

And almost 60% of 55+ renters said they would prefer to either move closer to their families or in with them.

Homeowner preferences

For homeowners aged 55 or more years, the top factors influencing whether and where they will move:

- the affordability of living in a particular community (46%);

- having the amenities needed to live there for many years after retirement (44%);

- less maintenance (41%);

- proximity to other family members (31%);

- having a place without responsibility for caring for the property, such as yard work and snow removal (30%);

- being in a walkable community (28%);

- having abundant services for adults of a similar age (25%);

- warmer climate (19%);

- having a place that is smaller than the current home (19%); and

- access to public transportation (17%).

The plans expressed by the survey participants could “create significant new pressure on both the supply and cost of existing affordable rental housing,” said David Brickman, executive vice president of Freddie Mac Multifamily. And they could “have an enormous impact on the demand for housing and new mortgage credit for the foreseeable future,” said Dave Lowman, executive vice president of Single-Family Business at Freddie Mac. The generation holds almost two-thirds, or approximately $8 trillion, of the nation’s home equity, Lowman added.

The survey was conducted by GfK on behalf of Freddie Mac and is based on online interviews of almost 6,000 homeowners and renters.