First, the upward trends. Seniors housing annual inventory growth rate was at its fastest pace in the fourth quarter of 2016 since at least 2006, with assisted living seeing the strongest gains. Net absorption of senior living units also reached a record high level during the quarter.

First, the upward trends. Seniors housing annual inventory growth rate was at its fastest pace in the fourth quarter of 2016 since at least 2006, with assisted living seeing the strongest gains. Net absorption of senior living units also reached a record high level during the quarter.

Asking rent also experienced its fastest growth rate in almost 10 years, with independent living properties seeing the fastest same-store growth.

Now, the downward trends. Occupancy for assisted living was at its lowest level in the fourth quarter of 2016 since early 2010.

Current construction as a share of existing inventory for seniors housing was at its lowest level since the second quarter of 2015. On a four-quarter basis, construction starts saw their weakest pace since the fourth quarter of 2014.

Those are some of the highlights (or lowlights) of data released Monday by the National Investment Center for Seniors Housing & Care’s MAP Data Service.

The details:

Occupancy

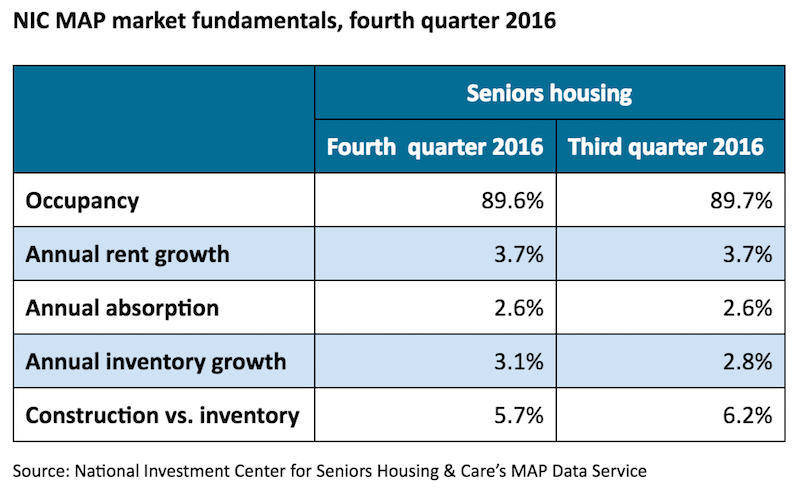

The occupancy rate for seniors housing properties in the fourth quarter of 2016 averaged 89.6%, as net additions in inventory outpaced absorption of units. This rate represented a decrease of 0.1 percentage point from the previous quarter and was down 0.5 percentage point from year-earlier levels.

During the past four years, occupancy has averaged 89.7%. As of the fourth quarter, occupancy was 2.7 percentage points above its cyclical low of 86.9% during the first quarter of 2010 and 0.7 percentage point below its most recent high of 90.3% in the fourth quarter of 2014.

The occupancy rate for independent living properties averaged 91.1% during the fourth quarter of 2016. When compared to the previous quarter, the occupancy rate for independent living was up 0.1 percentage point. Occupancy for independent living was down 0.2 percentage point from its year-earlier seven-year high of 91.3%.

The occupancy rate for assisted living properties averaged 87.6% during the fourth quarter of 2016. The occupancy rate for assisted living was down 0.3 percentage point from the third quarter and down 0.7 percentage point from year-earlier levels. Occupancy for assisted living was at its lowest level since early 2010.

Absorption and inventory

Seniors housing annual absorption was 2.6% as of the fourth quarter of 2016, unchanged from the third quarter of 2016 and up from 2.3% one year earlier. The seniors housing annual inventory growth rate in the fourth quarter of 2016 was 3.1%, up 0.3 percentage point from the previous quarter and its fastest pace since at least 2006.

“It was a very active quarter for inventory growth. More than 5,900 units were delivered on a net basis, the most in a single quarter since NIC’s data collection began in 2006,” Beth Burnham Mace, chief economist for NIC, said in a statement. “Inventory gains were strongest in assisted living, where nearly 4,100 units came online. The growth was not surprising in light of the number of units started 18 to 24 months ago — it often takes 18 to 24 months from groundbreaking to opening. It is also notable that net absorption of senior living units reached a record high level during the quarter. Demand was very strong, just not strong enough to offset the growth in inventory.”

Construction

Current construction as a share of existing inventory for seniors housing slowed 0.5 percentage point from its recent high of 6.2% in the third quarter of 2016 to 5.7% as of the fourth quarter of 2016 and was at its lowest level since the second quarter of 2015.

Seniors housing construction starts during the fourth quarter of 2016 preliminarily totaled 3,554 units, which included 882 independent living units and 2,672 assisted living units. On a four-quarter basis, starts totaled 17,719 units, the weakest pace since the fourth quarter of 2014.

Asking rent

During the fourth quarter of 2016, the average rate of seniors housing’s annual asking rent growth was 3.7%, which was the same as in the previous quarter and 0.9 percentage points above its pace one year earlier during the fourth quarter of 2015.

“This was the same growth rate that we saw in the third quarter and marked the fastest growth rate for asking rents in nearly 10 years,” Chuck Harry, NIC’s chief of research and analytics, said in a statement. “From year-earlier levels, this same-store growth was fastest for independent living properties, whose asking rents increased by 4.0%, compared with the 3.1% gain seen in assisted living properties.”

From the February 01, 2017 Issue of McKnight's Senior Living