Senior housing starts in the first quarter showed a “marked slowdown in activity for the second consecutive quarter,” said Beth Burnham Mace, chief economist for the National Investment Center for Seniors Housing & Care. “The decline in starts may suggest that the market is responding to well-publicized concerns about supply,” she added.

Seniors housing construction starts during the first quarter preliminarily totaled 2,737 units, including 802 independent living units and 1,935 assisted living units, according to data released April 6 by NIC’s MAP Data Service. On a four-quarter basis, starts totaled 19,243 units, the weakest pace in a year.

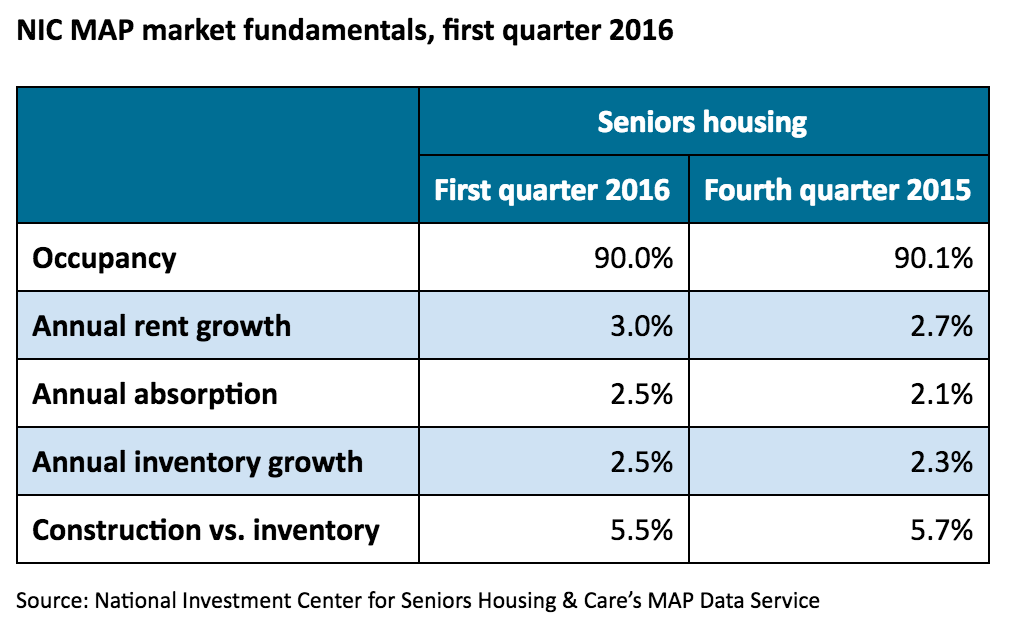

The annual inventory growth rate in the first quarter was 2.5%, up 0.2 percentage points from the previous quarter and its strongest pace since 2009. Current construction as a share of existing inventory for seniors housing slowed 0.2 percentage points to 5.5% as of the first quarter, although it is still up 0.4 percentage points from the first quarter of 2015.

The annual inventory growth rate in the first quarter was 2.5%, up 0.2 percentage points from the previous quarter and its strongest pace since 2009. Current construction as a share of existing inventory for seniors housing slowed 0.2 percentage points to 5.5% as of the first quarter, although it is still up 0.4 percentage points from the first quarter of 2015.

“Inventory growth continues to pressure occupancy rates,” Mace said.

The average occupancy rate for seniors housing properties in the first quarter was 90%, as net additions in inventory outpaced absorption of units. The rate represents a decrease of 0.1 percentage points from the previous quarter and is unchanged from year-earlier levels.

Occupancy has been hovering near 90% for the past two years, NIC noted. As of the first quarter of 2016, it was 3.2 percentage points above its cyclical low of 86.9% during the first quarter of 2010.

The occupancy rate for independent living properties averaged 91.3%, down 0.1 percentage points from its eight-year high in the fourth quarter. Occupancy for independent living was up 0.1 percentage points from year-earlier levels, however.

The occupancy rate for assisted living properties averaged 88.3%, unchanged from both fourth quarter and year-earlier levels.

During the first quarter of 2016, the rate of seniors housing’s annual asking rent growth was 3%, which was 0.3 percentage points above the previous quarter’s pace and 0.5 percentage points above its pace one year earlier during the first quarter of 2015.

“The pace of asking rent growth was its highest since 2008,” said Chuck Harry, NIC’s chief of research and analytics. “This strong same-store rent growth reflects the market’s current relatively balanced supply and demand trends, as absorption has largely kept pace with strong inventory growth during the past couple of years.”

Seniors housing annual absorption was 2.5% as of the first quarter of 2016, compared with 2.1% during the fourth quarter of 2015 and 2.2% one year earlier, during the first quarter of 2015.

Information related to specific metropolitan markets is available online.