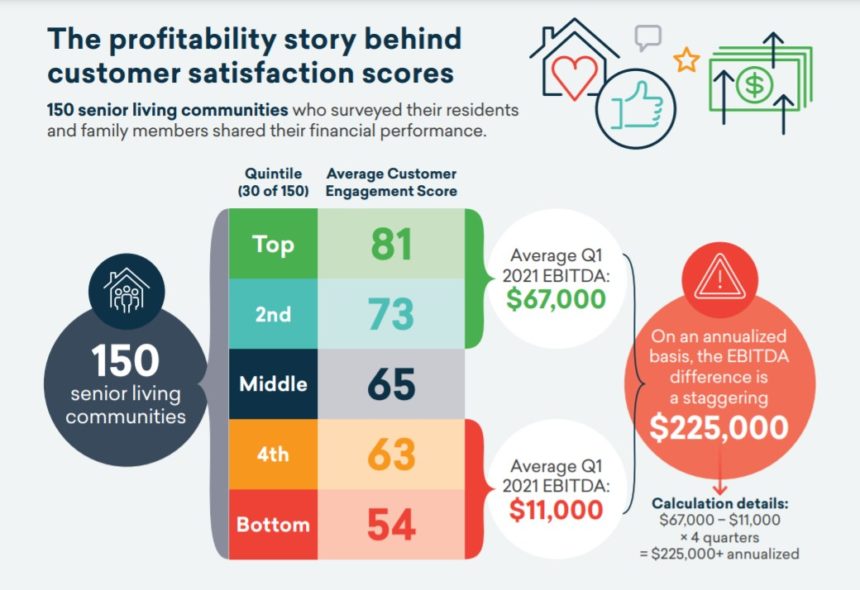

Two blind spots are costing senior living companies up to $225,000 of earnings before interest, taxes, depreciation and amortization, or $2.8 million of value per community, according to a new report with data from an Activated Insights survey of 63,807 residents and family members.

Senior living leaders, according to Activated Insights CEO Jacquelyn Kung, DrPH, MBA, often don’t know which communities best represent their brands, and they often miss high net promoter scores — a measure of customer experience — that may be disguised by the “movable middle” and not reflective of having great customer promoters.

In lower-scoring communities, word-of-mouth referrals are much lower, and resident move-outs due to dissatisfaction are three times higher than previous surveys, according to the data. Within one brand, Activated Insights said, customer engagement scores can range from 20 to 100 on a 100-point scale, which can affect consumers’ perception of an entire brand.

“With 2021 average net promoter scores for seniors housing averaging a negative eight — on par with CVS / Cigna / Comcast customer experiences — CEOs are missing the data to forecast profitability,” according to the report. “Across the industry, senior living promoters are much happier than the aggregate implies. The ‘good’ movable middle score flattens the overall assessment.”

Happy — for the most part

Overall, Activated Insights found that senior living organizations checking the pulse of their communities as they reopen from the pandemic are finding happy residents and family members — for the most part.

Data from the survey, which included the time period of February to June, found that overall satisfaction with independent living rose from 86% in April to 89% in June as communities reopened dining and activities. In assisted living, overall satisfaction stayed the same, at 87%, although resident satisfaction increased to 91%. Satisfaction scores in memory care among family members declined from 94% in April to 88% in June.

As expected, dining scores went up from the April reporting period to June, with independent living moving from 72% to 73%, assisted living increasing from 77% to 79%, and memory care rising from 86% to 93%.

But the areas that families and residents scrutinized before COVID-19 are becoming more important as communities reopen and some sense of normalcy returns, according to Kung.

The survey showed that satisfaction with management decreased, with net promoter scores sliding into negative territory.

Opportunity

What can senior living providers do to maximize their performance opportunities?

Activated Insights suggests establishing baseline customer engagement scores by surveying residents and family members in real time, tying customer engagement scores data to community-level financial metrics (occupancy, EBITDA [earnings before interest, taxes, depreciation and amortization], move-ins and move-outs) to identify gaps in communities and customer segments, and create clear customer engagement score goals, monitor improvement plans and “pulse check” customers to ensure experiences are improving.

“The key is to tie how happy your residents and family members are to property-level EBITDA — or [net operating income] for non-profits,” according to the report. “Then, translate the figures into property valuations.”