More than 11 million older adults (72%) will not be able to afford assisted living by 2033, and they likely won’t qualify for Medicaid to pay their long-term care needs either, according to a new analysis conducted by NORC at the University of Chicago.

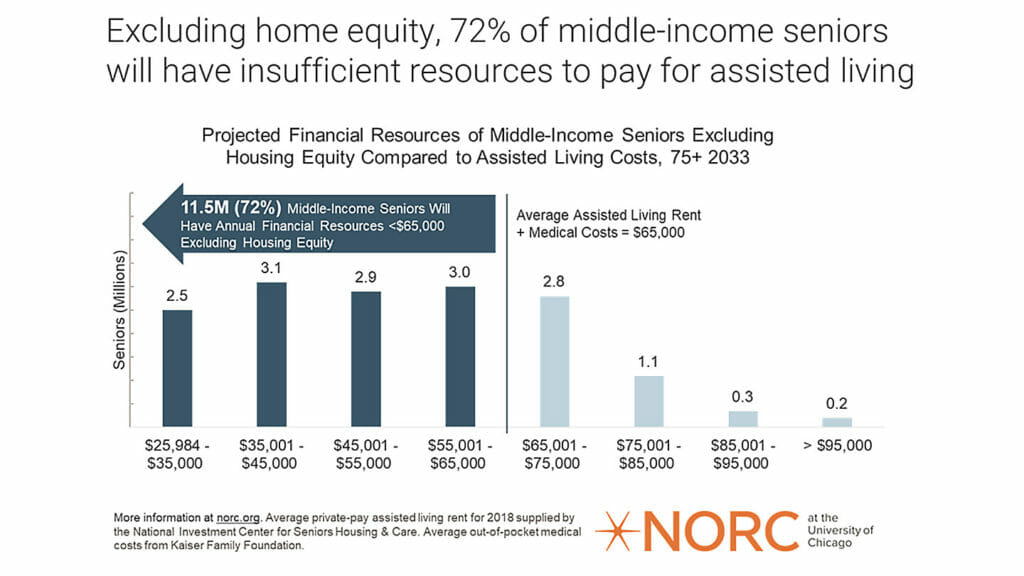

In an update to their “Forgotten Middle” study from 2019, researchers determined that 11.5 million older adults (72%) won’t qualify for public assistance and likely will be unable to pay for their long-term care needs on their own. In 2033, the investigators found, those older adults will have less than $65,000 in income and annuitized assets, the average amount needed to pay for private assisted living and medical care. Even if those older adults sold their homes, 6.1 million (39%) still would have insufficient resources to pay those annual costs, according to the analysis.

The 2019 study had found that 54% of the 14.4 million middle-income older adults in 2029 would lack the financial resources to pay for senior housing and care.

“Without a comprehensive long-term care system in this country, for all but the lowest-income individuals, the costs of senior housing and caregiving support falls to seniors and their families,” lead author of the new study and NORC Senior Vice President Caroline Pearson said in a statement. “Sadly, most middle-income seniors may not have the financial resources to pay for the care they want and need.”

In the study released today, the researchers found that the size of the middle-income population of older adults will increase by 7.5 million (89%), to 16 million, from 2018 to 2033, with the number of those aged 75 to 84 growing by 5 million.

Among the other key findings from the study is that more than half of future older adults will have three or more chronic conditions — 56% will have mobility limitations and 31% will face cognitive impairment, a figure that will jump to 40% for those 85 and older — making it difficult for them to live independently. The researchers said this population will need to rely more on paid caregivers because a majority will be unmarried in 2033, and many won’t have children living nearby.

The study also looked at the overall size of the older adult population — which will increase by 64% by 2033, whereas the number of those 85 and older will increase by 4.1 million — as well as diversity among the aging population, education rates and housing equity.

The older adult population is becoming more racially and ethnically diverse, with people of color making up 22% of middle-income older adults by 2033, the investigators said. The long-term care system should be responsive to the cultural needs and preferences of a more diverse aging population, they said.

The new analysis was funded by The SCAN Foundation, used data from the Health and Retirement Study and examined individuals aged 60 and older in 2018.

The 2019 study was funded by the National Investment Center for Seniors Housing & Care with support from the AARP, the AARP Foundation, the John A. Hartford Foundation and the SCAN Foundation.