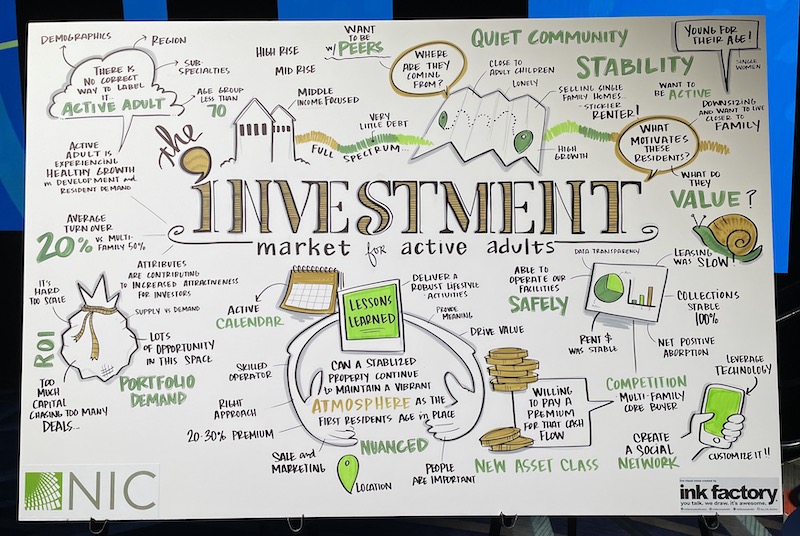

HOUSTON—As operators wrestle with determining a firm definition of active adult housing and related questions, the sector is experiencing growth in development and resident demand, said panelists participating in a session Monday at the National Investment Center for Seniors Housing & Care Fall Conference. It’s worth attention from long-term care providers, they said.

The average age of active adult community residents is 72 to 74, which means that such communities can be an attractive fit for those operators wishing to serve the leading edge of the “silver wave” now rather than have older adults age into independent or assisted living, noted Zachary Crowe, principal of the Carlyle Group.

“Our thesis was all about the baby boomers,” he said, noting that the oldest members of this generation are turning 75 this year.

Regardless of the income level a property is aimed at, “one thing we hear all the time is that our residents really want to be with their peers. The No. 1 marketing thing to say that triggers them to come look at our properties is ‘55 and older,’ ” Crowe said. “They want to be in a quiet community with their peers that has programming that’s catered toward their interests. …That’s really a big deal for these folks.”

But, he stressed, markets can vary.

“After almost 10 years of this, we’re still learning every day what motivates these residents to move into one property over another,” Crowe said.

‘Very, very clear winner’ during pandemic

Active adult housing has been a “very, very clear winner” during the pandemic compared with other types of real estate, said session moderator Aron Will, vice chairman, debt and structured finance, and co-head of senior housing, for CBRE.

“You didn’t have the same issues with respect to inhibiting the ability of residents to move in, so the front door was still open, although leasing was slower” than normal, he said. The sector had good collections and renewals and “phenomenal rent growth,” Will added.

Because care and many amenities are not offered, Crowe said, each community can be fully staffed with four to eight full-time equivalent people — much fewer than a senior living community or skilled nursing facility. This reality means that active adult communities aren’t experiencing labor pressures at the level that long-term care properties are.

“Having that low staffing level — I think that was one of the key ingredients,” he said.

Lessons learned

Asked to share lessons learned, Jeff Patterson, co-founder and CEO of Sparrow Partners, noted that the sales cycle is faster for active adult properties than for senior living communities, but it’s slower than the sales cycle for multifamily housing. The lengthier time frame compared with multifamily housing, he said, is due to the involvement of adult children in the decision-making process as well as the seriousness with which older adults approach a move into a community, often needing to sell a single-family home beforehand and also thinking that the apartment could be a long-term residence.

The difference is an important consideration when seeking sales professionals who will find the interactions appealing, Patterson added.

Ayesha Menon, senior vice president of wellness housing and development at Welltower, said, “We’ve just been pretty stunned at how important micro and macro location is.” Deviation in performance is “tremendous,” she added. “If you can crack the code on what will lead to great long-term performance, I think there’s a big opportunity there.”

A key to keeping costs down as an operator, Patterson said, is creating amenity spaces that allow for flexibility, so that they can be used for multiple purposes.

Multiple benefits

Even without a unified definition of active adult communities, panelists agreed that such housing offers benefits to older adults.

“This is a product, especially in the middle market, that provides community for folks that there’s not currently a product for that they can afford,” Patterson said, later adding: “What we are doing … is very meaningful — not just the housing option. It’s providing meaning and engagement and, we think, years on our residents’ lives.”

Crowe said: “We’ve had so many residents come in that have never done water aerobics before, done yoga or tai chi. And all of the sudden, they start doing it, and they’re healthier for moving into these properties.” Voids exist in many markets, he added.

Menon agreed. “There’s not a lot of this product out there, and there’s a tremendous need,” she said.

Approximately 2,400 people are attending the NIC Fall Conference — operators, capital providers and others — according to NIC.

2 new partners for Actual Rates initiative

Also on the first day of the meeting, NIC announced that two additional software companies — Eldermark and Glennis Solutions — now are certified as partners of the organization’s Actual Rates initiative. This means they can offer their senior living operator customers an easier and more efficient means to regularly share their actual rates data with NIC. Those data are the most accurate data on the monthly rates residents pay to live in senior living communities.

“Actual rates data are comparable to data available in other real estate asset classes. By making these data available in senior housing, NIC is helping improve transparency and enabling capital to make more informed decisions,” the organization said. Actual rates data are aggregated across operators and reported to help investors and operators understand the relationship between “asking rate” or “rate card” pricing and the actual rate being paid by residents, NIC said.

Other, previously announced NIC Actual Rates initiative software partners:

- Alis

- MatrixCare

- PointClickCare

- Yardi

The meeting continues through Wednesday.