The Senior $afe Act, a bipartisan bill with the goal of helping to protect older adults from financial exploitation and fraud, unanimously passed in the House of Representatives on Monday and is expected to be considered by the full Senate soon.

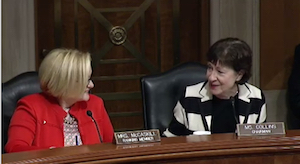

The bill, sponsored by Sens. Susan Collins (R-ME) and Claire McCaskill (D-MO), had passed the Senate Banking Committee in December.

It’s the fourth time federal lawmakers have tried to make it easier for financial institutions to report suspected fraud against older adults to the proper authorities with a bill of a similar name. Similar acts were introduced in 2017 and 2015, and the House of Representatives considered the Senior$afe Act of 2016, but none ultimately became law.

The Senior$afe Act would protect banks, credit unions, investment advisers, broker-dealers, insurance companies and insurance agencies from being sued for reporting suspected exploitation or fraud as long as they have trained their employees about how to identify the warning signs of common scams and make reports in good faith to the proper authorities.

Collins is chairman of the Senate Special Committee on Aging, and McCaskill is the former ranking member and currently is a member.

The bill has 26 co-sponsors in the Senate — Republicans, Democrats and an independent — and has been endorsed by the AARP and several financial, credit union and banking-related organizations.