Older baby boomers’ top choice of where to live if they were to have dementia is a senior living community, according to the results of a new LeadingAge–NORC poll revealed Monday at the LeadingAge Leadership Summit in Washington, D.C. The finding, according to LeadingAge, was one of several from the research that challenge commonly held views of baby boomer preferences related to aging.

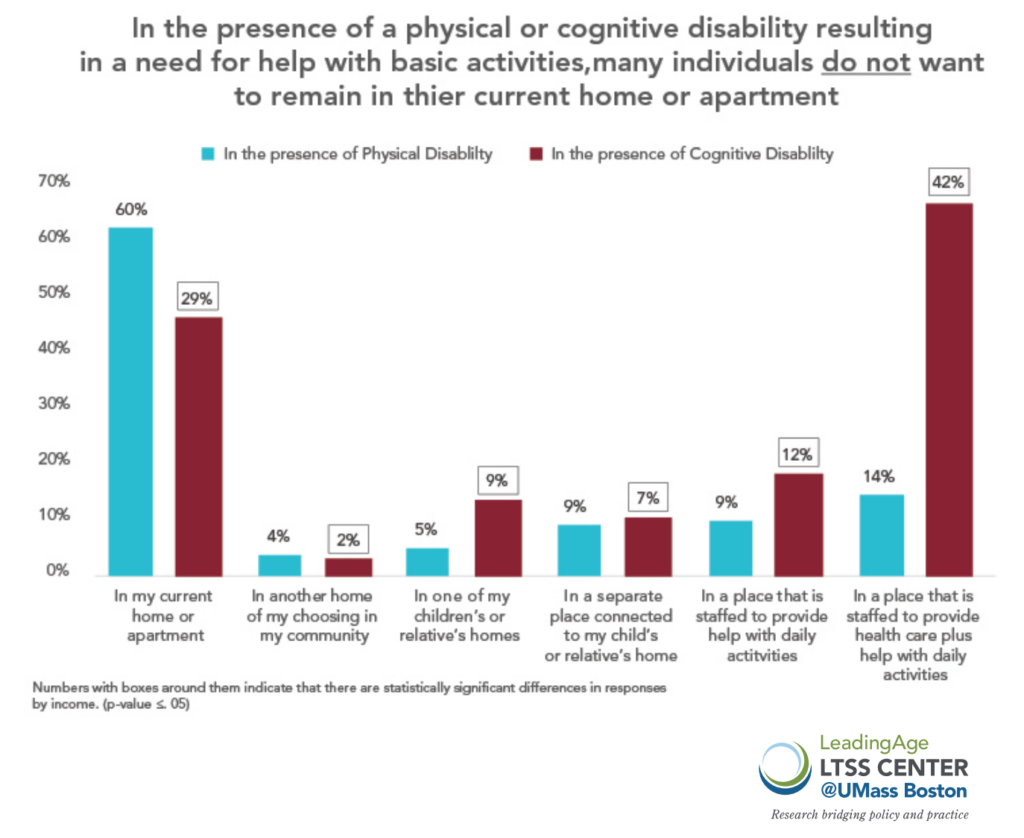

When asked where they would want to live if they had a physical disability and needed assistance with activities of daily living, the majority (60%) of the 1,283 survey respondents said they would want to remain in their current home or apartment. When presented with a scenario in which they had a cognitive disability and needed ADL help, however, the greatest percentage of respondents (42%) said they would prefer to live “in a place that is staffed to provide healthcare plus help with daily activities.” A preference to remain at home dropped to 29% of participants in the cognitive disability scenario.

The finding was surprising given that previous studies had reported that most adults want to remain in their own homes as they age, LeadingAge said. The organization noted, however, that earlier studies had not targeted only older baby boomers, as did the LeadingAge study, and had not included questions that distinguished between physical and cognitive impairment.

LeadingAge, in conjunction with NORC, surveyed adults aged 60 to 72 years in January via mail, telephone and by in-person interviews. The age range was selected, the organization said, because people of those ages are more likely to have peers who already may be experiencing the need for ADL assistance and more easily can imagine themselves in such a position. The youngest baby boomers turn 55 this year.

“These older baby boomers are expecting a full continuum of services, including home care, other community-based supports, affordable housing with services, assisted living and nursing homes,” LeadingAge President and CEO Katie Smith Sloan said. “Boomers have had a lot of choices all their lives. As the population ages, it is our responsibility to keep providing the highest-quality, most person-centered options and to continue finding new ways to serve those who need long-term services and supports.”

Technology use by older boomers

Survey results also provide insights into the oldest boomers’ use of technology, suggesting effective ways to reach prospective residents.

Forty-one percent of respondents said they “don’t use” or “barely use” social media, and 30% said they use it but spend “much more time” interacting with people in other ways. Twenty-seven percent, however, said they are frequent users of social media.

Internet use among respondents was relatively high, at 82%. Use was higher among those in higher income brackets.

Overall, however, almost 20% of respondents reported having no internet access at home. For those in the lowest income group, more than one-third (34%) had no internet at home.

Additionally, 55% of poll-takers said they had both a cell phone and a landline; having both increased “significantly” with income, LeadingAge said. Cell phone-only ownership declined with age, and landline-only ownership increased with age.

Also, those in higher income brackets were 13 times more likely to have only a cell phone rather than only a landline, whereas low-income individuals were almost twice as likely to only have a landline rather than only have a cell phone.

Other survey highlights:

- When asked, “What would worry you most about hiring someone” to provide care, wealthier baby boomers were twice as likely as those with lower incomes to indicate that they would be most concerned about caregivers not being able to meet their needs. “Previous studies have shown us that wealthier older adults have higher expectations than lower-income people,” LeadingAge said. “This survey underscores the fact that providers need to pay attention to the skills and competencies of their staff so that they can, in fact, meet the needs and preferences of their life plan community residents and provide competitive staffing in their home- and community-based services.”

- When asked about their expected financial resources during retirement, 93% of respondents said they would have Social Security, 53% said they would have retirement savings, 44% said they would have a pension guaranteeing a fixed income, 32% said they would have other savings, and 14% said they would have long-term care insurance.

- 39% of respondents said that, other than their homes, they had saved between $100,000 and $500,000 for retirement, 18% said they had saved less than $50,000 for retirement, and 15% said they had saved between $50,000 and $100,000.

Read more survey results here.