Senior living and care operators and other organizations that use temporary workers or contractors through staffing agencies now have some clarification from the Department of Labor around the standard for when a worker should be deemed an employee versus an independent contract under the Fair Labor Standards Act.

A final rule, released Wednesday, will take effect March 8 and clarifies whether the business for which a worker does work can pay them minimum wage or must pay overtime. The rule essentially reaffirms an economic reality test to determine whether an individual is in business for himself or herself, making the individual an independent contractor, or is economically dependent on a potential employer for work, making the person an FLSA employee, the agency said.

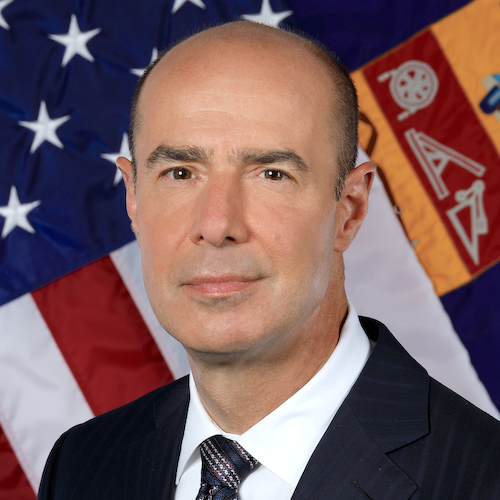

To get at that difference, U.S. Secretary of Labor Eugene Scalia said that the rule focuses primarily on who is in control of the work and whether the worker has the opportunity for profit or loss resulting from his or her own initiative or investment.

“This rule brings long-needed clarity for American workers and employers,” Scaia said in a statement. “Sharpening the test to determine who is an independent contractor under the Fair Labor Standards Act makes it easier to identify employees covered by the Act, while recognizing and respecting the entrepreneurial spirit of workers who choose to pursue the freedom associated with being an independent contractor.”

The rule includes two core factors that are most probative to the question of whether a worker is economically dependent on someone else’s business or is in business for himself or herself: the nature and degree of control over the work, and the worker’s opportunity for profit or loss based on initiative and/or investment.

It also identifies three other factors that may serve as additional guideposts in the analysis, particularly when the two core factors do not point to the same classification. The factors include the amount of skill required for the work; the degree of permanence of the working relationship between the worker and the potential employer; and whether the work is part of an integrated unit of production.

“Streamlining and clarifying the test to identify independent contractors will reduce worker misclassification, reduce litigation, increase efficiency, and increase job satisfaction and flexibility,” Wage and Hour Division Administrator Cheryl Stanton said. “The rule we announced today continues our work to simplify the compliance landscape for businesses and to improve conditions for workers.”