The Federal Reserve’s rising interest rates are starting to weigh on commercial real estate investors, Marcus & Millichap reported, although transaction activity was at an above-average pace through midyear.

“Moving through the third quarter into the final period of the year, the combined impact of higher prices and interest rates on the finances of households and business may begin to curb the trajectories of some sectors,” Marcus & Millichap said.

The Federal Reserve increased its target interest rate Wednesday by three-quarters of a percentage point in a strategic move to slow inflation. The Consumer Price Index increased to 8.3% in August from the same month a year ago.

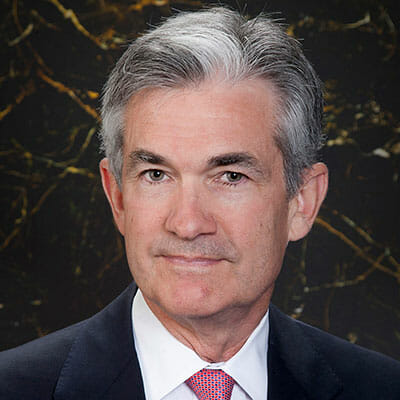

“We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2%,” Chairman Jerome Powell said at a press conference following the announcement, adding that “it’s very hard to say with a precise certainty the way this is

going to unfold.”

National Investment Center for Seniors Housing & Care Chief Economist Beth Burnham Mace previously told the McKnight’s Business Daily that a downside to interest rate hikes for senior living providers is that fixed mortgage rates will increase, which could make it more difficult for older adults to sell their homes and move into senior living communities. The proceeds from home sales often are used to finance such moves.

This is the third 75-basis-point increase this year, and it is probably not the last.

“Indeed, the central bank expects the target for the federal funds rate will increase by 75 more basis points in November, 50 in December, and then conclude with 25 points at the start of 2023,” National Association of Home Builders Chief Economist Robert Dietz speculated.