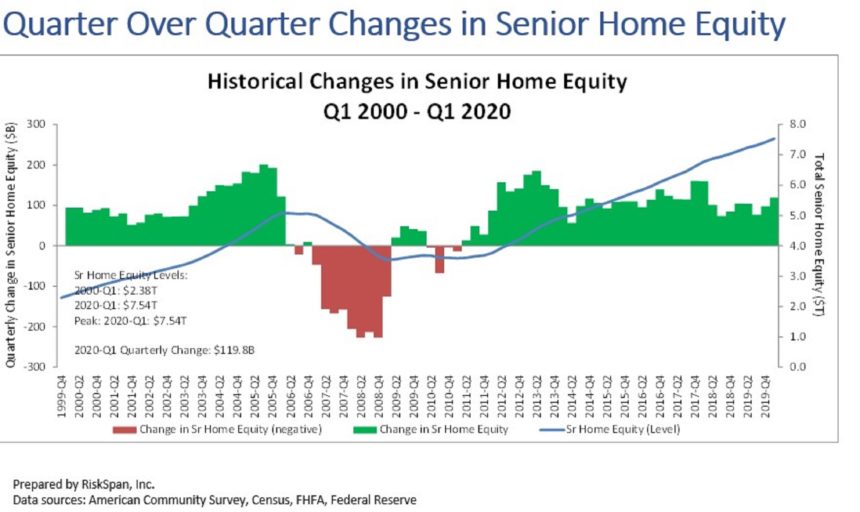

Homeowners aged 62 years and older saw their housing wealth grow by 1.6%, or $120 billion, in the first quarter, according to a report released Friday from the National Reverse Mortgage Lenders Association.

The quarterly NRMLA/RiskSpan Reverse Mortgage Market Index rose in the first quarter of 2020 to 271.58, an all-time high since the index was first published in 2000. The firm said the increase in senior homeowner’s wealth mainly was driven by an estimated 1.4%, or $132 billion, increase in senior home values, offset by a 0.7%, or $12.3 billion, increase in senior-held mortgage debt.

In another report published Friday, this one by the Center for Retirement Research at Boston College, researchers found that market shocks are a growing concern to more than half of U.S. households who now own equities, mainly due to the shift from traditional pensions to 401(k) plans.

Between February and March, the value of equities in employer-sponsored retirement plans and household portfolios fell by $14.2 trillion, according to the report. Of that decline, $4.4 trillion occurred in 401(k)s and individual retirement accounts, $1.8 trillion in public and private defined benefit plans, and $8 trillion in household non-retirement assets.

“COVID-19 has impacted millions of families and their retirement portfolios, and market shocks are a growing concern for many families whose retirement assets are in 401(k)s,” NRMLA President Steve Irwin said. “The responsible use of home equity may be an option to help mitigate certain market risks and help seniors stay financially secure during future market disruptions.”