Homeowners aged 62 and older increased their home equity by 3.98% in the fourth quarter of 2021 to a record $10.6 trillion from the previous quarter, according to the National Reverse Mortgage Lenders Association. That’s a difference of $405 billion.

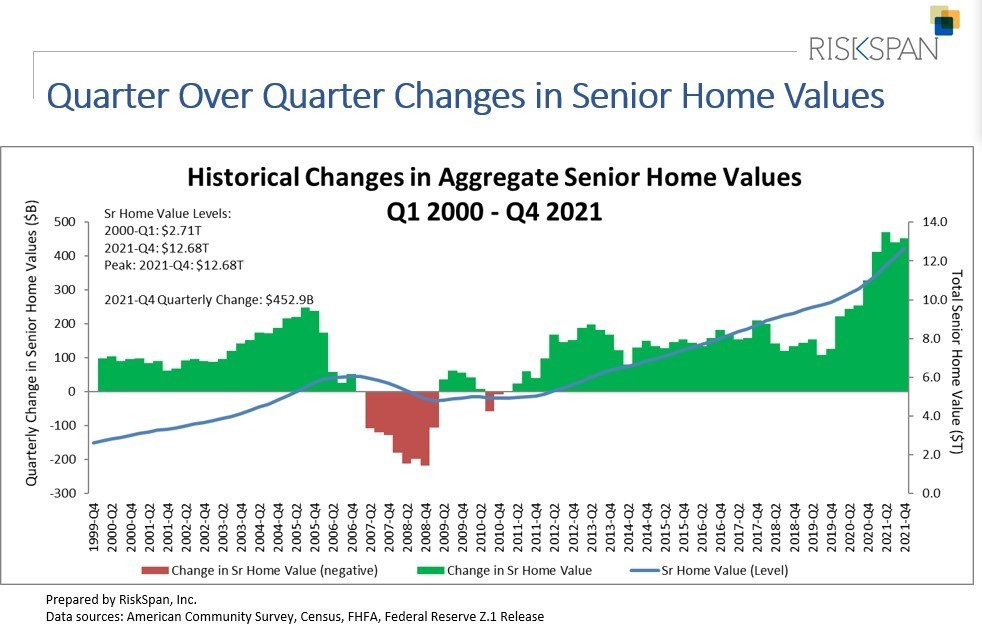

The NRMLA/RiskSpan Reverse Mortgage Market Index rose in the fourth quarter to 370.56, another all-time high since the index first was published in 2000. According to the latest index quarterly report, the increase in older homeowners’ wealth mainly was driven by an estimated 3.7%, or $452 billion, increase in home values, offset by a 2.3%, or $47 billion, increase in senior-held mortgage debt.

“To help ameliorate the risks and concerns surrounding the ability of homeowners to age their way, it is critical that housing wealth is carefully and responsibly considered when developing a comprehensive retirement plan,” NRMLA President Steve Irwin said in a statement. “For many, housing wealth is indeed their greatest asset, and tapping that equity, under the right circumstances, will enable a secure path to aging security.”

Reverse mortgages are a “versatile tool” to help many older adults maintain their financial security in retirement by allowing them to borrow against the equity in their homes without having to make monthly principal or interest payments as they would with a traditional mortgage or a home equity loan, according to NRMLA. A homeowner receives funds while interest accrues, but the outstanding balance is not due until the last borrower leaves the home, sells it or passes away. To date, the organization said, more than 1.21 million households have used an FHA-insured reverse mortgage to help meet their financial needs.

Reverse mortgages aren’t just for homeowners short on cash anymore, the New York Times reported earlier this month.

“The best use of this tool is to provide and supplement income during retirement,” Craig Lemoine, the director of the financial planning program at the University of Illinois, Urbana-Champaign, told the media outlet. “A younger retiree can stay in the house while turning equity into an income stream.”