Rising operating expenses will limit the degree to which operating margins will grow in the next six months. This has contributed to waning optimism, according to the latest Executive Survey Insights report released Thursday by the National Investment Center for Seniors Housing & Care.

The Wave 42 survey includes responses from May 31 to June 26 from owners and executives of 61 small, medium and large senior housing and skilled nursing operators across the nation. The operators represent hundreds of buildings and thousands of units across respondents’ portfolios of properties.

Anticipated increases in operating margins have contracted since Wave 38 survey results were released in March. At that time, 75% of respondents said they expect operating margins to grow, and just 5% of respondents said they anticipate that their margins will decrease over the next six months. In the current survey, just over half of the respondents (58%) said they anticipate their organization’s operating margins to increase in the near future.

In Wave 42, about 1 in 5 respondents (18%) anticipate operating margins to increase by greater than 10%, about one-third (35%) anticipate operating margins to rise by 6%-10%, and few (5%) anticipate operating margins to grow by 1%-5%.

In the June survey, about a quarter of respondents (27%) said they anticipate operating margins to decrease between 1% and 5%, and one-eighth of respondents (13%) anticipate operating margins to decrease between 6% and 10%.

Despite the general expectations about growth, operating expenses are driving the waning optimism among the operators, the data shows. Most of the respondents (84%) indicated that their operating expenses have increased in the last six months. About 1 in 10 (11%) reported operating expenses have remained the same, and just 5% reported operating expenses have decreased since the beginning of 2022.

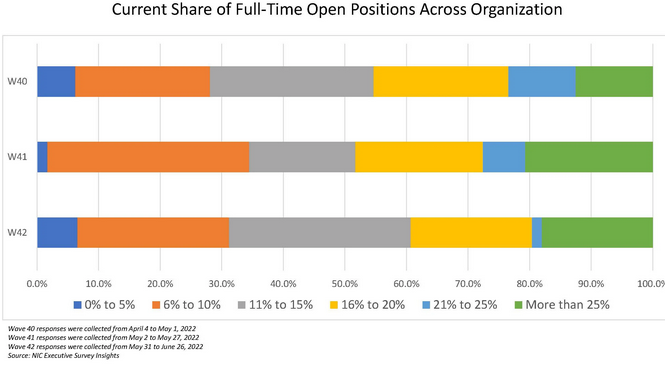

Operators are still concerned about staffing challenges, and more operators expressed concerns that the shortage will continue longer than anticipated. Respondents anticipating improvement in staffing challenges in 2024 doubled, from 10% to 20%, and respondents anticipated improvement in 2025 or later tripled from 10% to 30% from Wave 41 to Wave 42. A fifth of Wave 42 respondents reported the severity of staffing shortages to be severe, 71% reported them to be moderate, and 8% reported them as minimal