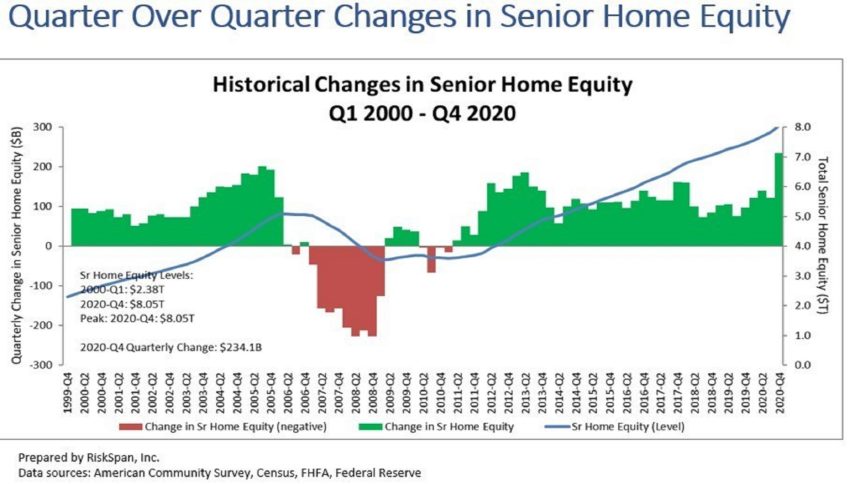

Homeowners aged 62 years and older saw their housing wealth grow by 3%, or $234 billion, in the fourth quarter, according to a report released Friday from the National Reverse Mortgage Lenders Association. The increase brings senior housing wealth to a record $8.05 trillion, the agency noted.

The NRMLA/RiskSpan Reverse Mortgage Market Index rose in the fourth quarter to 289.44, another all-time high since the index first was published in 2000. The increase in senior homeowner’s wealth mainly was driven by an estimated 2.7%, or $261 billion, increase in senior home values, offset by a 1.5%, or $27 billion increase, in senior-held mortgage debt.

Year-over-year, the RMMI increased by 8.3% in 2020, compared with 5.4% in 2019 and 6.3% in 2018, mainly driven by higher home price appreciation, the association reported.

“Reverse mortgages provide a strategic retirement option for older homeowners of all income levels,” NRMLA President Steve Irwin said. “Reverse mortgages allow people to pay for in-home care and other services that allow them to age in place or provide an alternative to selling retirement assets after a market downturn. While a reverse mortgage isn’t for everyone, it can provide the financial security that many people are looking for in retirement.”