The demand for seniors housing finally caught up with supply in the fourth quarter of 2018, according to the National Investment Center for Seniors Housing & Care.

“Not only was the fourth quarter’s increase in occupied seniors housing units the highest recorded since NIC began reporting the data back in 2006; the fourth quarter was the first quarter of the past three years during which the growth in occupied units managed to keep pace with the number of new units that came on line,” NIC Chief of Research and Analytics Chuck Harry said in conjunction with the release Thursday of NIC’s latest quarterly data. “In other words, this was the first quarter since the fourth quarter of 2015 during which the consumers’ increased demand for seniors housing kept pace with the increase in the inventory of new units. New demand and new supply during the quarter were on par with each other.”

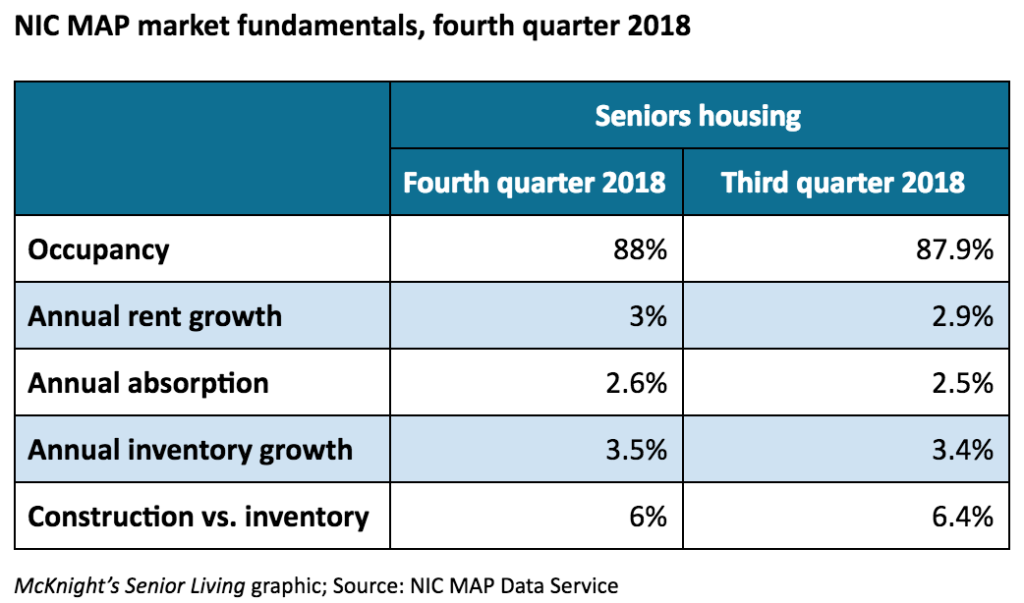

Overall occupancy was stable, averaging 88%, which was up 0.1 percentage point from the third quarter although down 0.7 percentage point from the fourth quarter of 2017, NIC said. Current occupancy is 2.2 percentage points below its most recent high of 90.2% in the fourth quarter of 2014, according to the organization.

Independent living occupancy averaged 90.2% during the fourth quarter, up 0.1 percentage point from the previous quarter and down 0.5 percentage points from a year ago. Assisted living occupancy averaged 85.4% during the fourth quarter, unchanged from the third quarter and down 0.9 percentage point from the fourth quarter of 2017.

Other metrics:

- Absorption: Seniors housing annual absorption — the change in the occupied units from the previous quarter — was 2.6% as of the fourth quarter, up 0.1 percentage point from the third quarter of 2018 and up 0.3 percentage point from the fourth quarter of 2017, according to NIC.

- Inventory growth: The seniors housing annual inventory growth rate in the fourth quarter was 3.5%, up 0.1 percentages point from the third quarter, the organization said.

- Construction as a share of inventory: Preliminary data on construction as a share of existing inventory for seniors housing was 6% in the fourth quarter and was 1.3 percentage points below its recent high of 7.3% in the fourth quarter of 2017, according to NIC.

- Construction starts: Seniors housing construction starts within the 31 primary markets measured by NIC MAP during the fourth quarter of 2018 preliminarily totaled 3,247 units. That number included 1,695 independent living units and 1,552 assisted living units. On a preliminary four-quarter basis, starts totaled 16,680 units. Construction starts data often are revised retrospectively in subsequent quarters as additional information becomes available, the organization said.

Assisted living feeling wage pressure

During the fourth quarter, the average rate of seniors housing’s annual asking rent growth was 3%, up 0.1 percentage point from the previous quarter and down from a recent high of 3.8% in the fourth quarter of 2016, NIC said. For comparison purposes, according to the organization, citing Bureau of Labor Statistics data, labor expense growth as measured by the annual change in assisted living average hourly earnings was 4.3% in the third quarter.

“Year-over-year quarterly hourly earnings growth for assisted living has exceeded 4% since early 2017, more than in many other sectors,” NIC Chief Economist Beth Burnham Mace said in a statement. “Because labor expenses account for roughly 60% of an operator’s expenses, this ongoing wage growth is putting pressure on operators’ ability to grow net operating income, especially in markets where revenue growth is being impaired by weak occupancy and slower rent growth.”