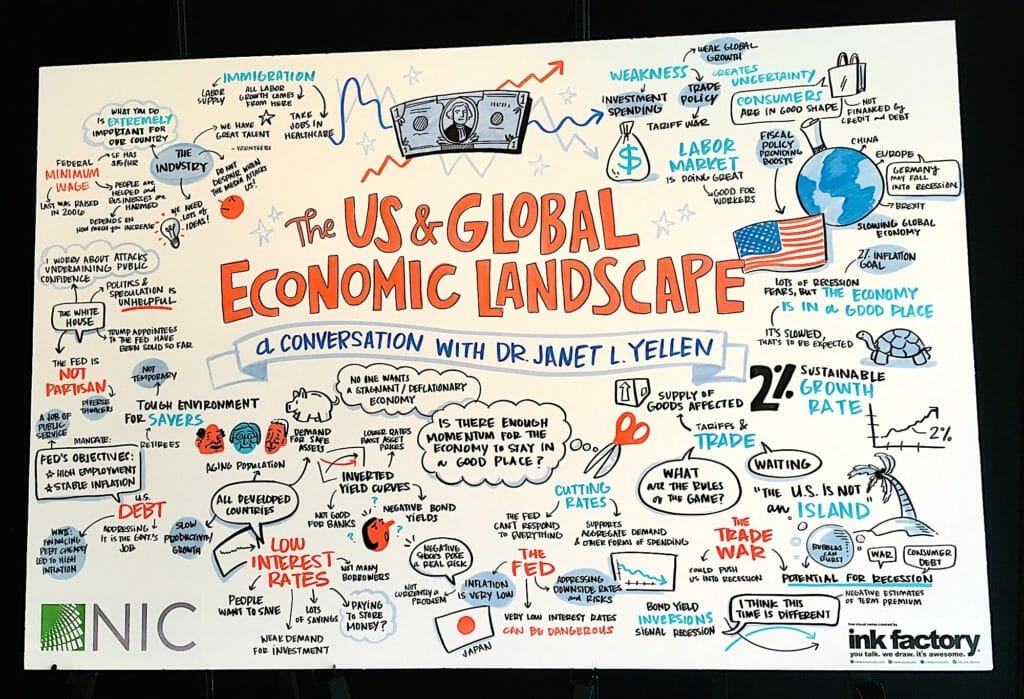

CHICAGO—Janet Yellen is not predicting a recession. At least not yet.

“Recession risks are quite a bit higher than I’m comfortable with, but if you ask me am I forecasting a recession, I still might say no,” the former Federal Reserve chair said Thursday. “Right now, the economy is in a good place. The only question is, is there enough momentum for it to stay in a good place?”

Her comments were part of a wide-ranging discussion with Kathleen Hays, global politics and policy editor for Bloomberg, as part of the opening session of the National Investment Center for Seniors Housing & Care Fall Conference.

When Hays asked whether a trade war could push the U.S. economy into a recession, Yellen said “could be.”

“It certainly resulted in a downturn in investment spending,” she said. “It’s led to a moderation in growth throughout the global economy.” But other factors, such as Brexit and geopolitical risks in other areas of the world, also would be factors, Yellen said.

Social Security, Medicare and Medicaid

The former Fed chair also said she is not worried about the debt to gross domestic product ratio in the United States right now, but added: “I’m worried about the trajectory of where it’s going. …It’s not stable. We’re not living within our means right now. Debt is going to escalate, and that’s going to create problems down the road.”

The matter could get to the point, Yellen said, where a future Congress won’t have much money left to spend after making interest payments on the debt.

“But then, most important is, the demographic wave that lies ahead of us is going to essentially, over the next 30 years, double spending on three programs — Social Security, Medicare and Medicaid — as a share of GDP,” she said. “And the increases, both because of the aging population and, on the healthcare side, medical expenses that have generally risen faster than the cost of other goods and services — those things put us on a trajectory of a completely unsustainable budget path.”

Don’t expect to hear about the issue on the campaign trail, though, Yellen said.

“Candidates for public office don’t like to talk about this,” she said. “They don’t like to tell you what their plans are for how they’re going to deal with a budget deficit.”

It’s “painful arithmetic” to figure out how to change the equation, Yellen said. Via revenues? Through spending cuts? And who will bear the burden? “This is root canal economics,” she said.

It’s a topic on which Congress already should have been focused, Yellen said, adding, “We’ve known about all of this for the last 30 years.”

Ultimately, Yellen said, Congress probably will find a way to “deal with it,” although perhaps not until market pressure causes the body to act. When that day comes, “you’re looking at three big entitlement programs that are utterly critical to the well-being of our nation’s retirees, and they are going to be on the table,” she said.

“I think it will not be solved without some additional revenues on the table, but I also find it hard to believe that it won’t be solved without some changes to those programs,” Yellen said. “So this is certainly something that people in this audience should have in their sights as something that will greatly affect the well-being of our cohort or, more likely, our children.”

Other thoughts the former Fed chair shared:

- Minimum wage. A recent Congressional Budget Office study found that raising the federal minimum wage to $10 an hour from the current $7.50 would help approximately 1.5 million workers and that the cost to business would be “absolutely minimal, essentially trivial,” Yellen said. Raising the federal minimum wage to $15 an hour would help even more families in the short term, according to the CBO, “but many more businesses would be hurt, and there would be costs in terms of long-term losses of jobs,” she said. One million jobs would be lost, the CBO forecasted. “The other side of it, though, is hiring labor and shortages of labor,” Yellen said. “It is conceivable that a higher minimum wage would attract people into the labor market who wouldn’t otherwise work.”

- Immigration. “As the baby boomers retire, we’re going to have a shrinking labor force, a lower labor force participation rate, and almost all the growth in labor supply is essentially through immigration,” she said. New immigrants tend to be less skilled and attracted to jobs in areas such as healthcare and construction, Yellen said. “It is projected that there’s going to be enormous growth in jobs in healthcare and home health aides, in nursing facilities and nursing, and immigration is very important in that,” she added.

- Presidential tweeting. “Although the Fed is an independent agency, and it was structured to stay out of politics and to be nonpolitical, it does need a broad base of public support,” Yellen said. “And I do worry about President Trump’s attacks on the Fed, because incessant attacks can begin to undermine public confidence in the Fed when that would be very unhelpful and damaging to its effectiveness as an institution trying to promote public interest.”

The NIC meeting ends Friday.