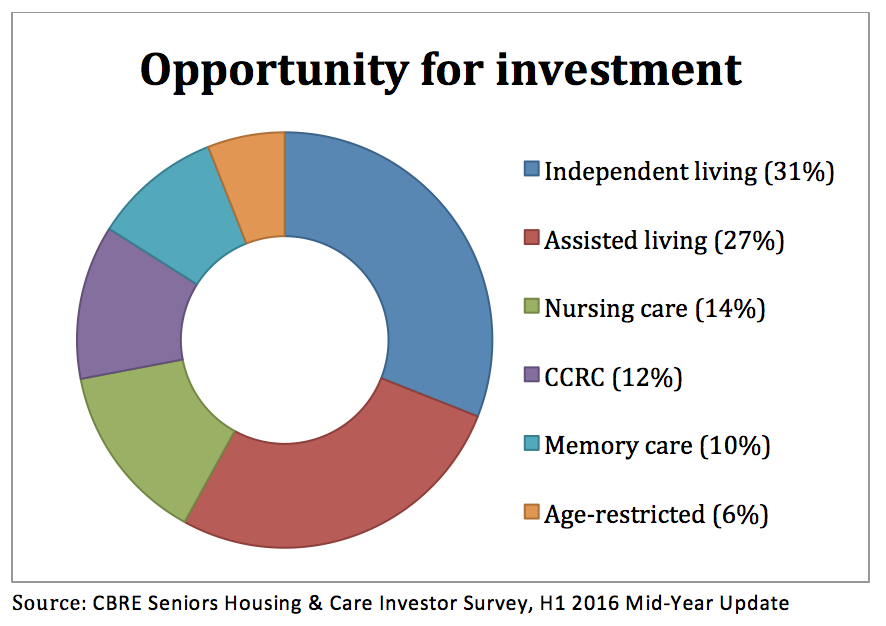

Independent living offers the biggest opportunity for investment in seniors housing, according to the latest CBRE Seniors Housing & Care Investor Survey, released Tuesday.

Thirty-one percent of respondents to the survey, which covers the first half of this year, cited independent living as the biggest investment opportunity. Assisted living was mentioned by 27%.

Skilled nursing also is gaining ground as a perceived investment option, the report said. Memory care properties, on the other hand, continue to lose ground, coming in fifth behind continuing care retirement / life plan communities and nursing care properties.

Overall, seniors housing remains an attractive investment, with returns outperforming other asset classes, according to the publication. One-, three- and five-year returns for seniors housing were 16.1%, 17% and 15.3%, respectively, whereas returns for multifamily properties were 12%, 10.9% and 11.9% during the same time, and the NCREIF Property Index averaged 13.3%, 12.0%, and 12.2% in the United States, the authors said.

Overall, seniors housing remains an attractive investment, with returns outperforming other asset classes, according to the publication. One-, three- and five-year returns for seniors housing were 16.1%, 17% and 15.3%, respectively, whereas returns for multifamily properties were 12%, 10.9% and 11.9% during the same time, and the NCREIF Property Index averaged 13.3%, 12.0%, and 12.2% in the United States, the authors said.

Just as in the overall U.S. commercial real estate market, transaction volume has declined in seniors housing, CBRE noted. The Los Angeles-based commercial real estate company, however, expects an increase in portfolio transactions in the second half of the year.

The top concerns of poll participants include construction activity, cited by 39% of respondents, and increased property-level operating and development costs, cited by 24%.

“The industry’s fundamentals suggest the necessity for more capacity over the long term, with short-term oversupply in select markets becoming more likely as properties currently under construction or planned for construction are delivered to the market,” the report authors said. “Sound property-level operations will be critical to maintaining valuations.”

CBRE sent its survey to more than 250 people, concentrating on transactional professionals who specialize in seniors housing and care. The response rate was 32%. Participants mainly were institutional investors, brokers and real estate investment trust representatives, with private capital investors and developers responding as well.