The occupancy rate for seniors housing across the United States in the third quarter, which averaged 87.9%, was at its lowest level since the second quarter of 2011, when it was 87.5%, according to new data released Thursday by the National Investment Center for Seniors Housing & Care. In assisted living, the rate remains near its lowest point since 2006, NIC said.

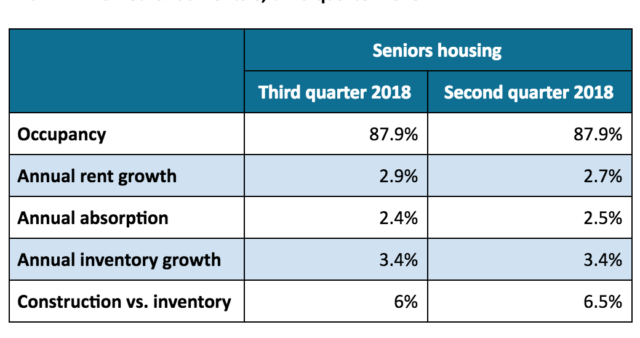

Occupancy in U.S. seniors housing properties, including independent and assisted living, remained unchanged from the previous quarter and down 0.8 percentage point from a year ago, NIC said.

“We continue to see many of the same trends that we saw earlier in the year, namely, that occupancy continues to be pressured lower by the introduction of new inventory and greater competition,” NIC Chief Economist Beth Burnham Mace told McKnight’s Senior Living. “Independent living has experienced less growth in inventory, but even in this product type, occupancy rates are being pressured lower, although they remain well above assisted living at 90.2 percent.”

Current occupancy across senior living is 2.3 percentage points below its most recent high of 90.2% in the fourth quarter of 2014, but “the number of occupied seniors housing units has actually increased during this same period by 8.9 percent, which equates to a solid 2.4 percent annual pace of increase,” NIC Chief of Research and Analytics Chuck Harry said in a statement. “It’s the fact that the rate of inventory growth has exceeded the absorption of units through this period that has driven the decline in the occupancy rate.”

In assisted living, occupancy averaged 85.3% during the third quarter, up 0.1 percentage point from the previous quarter but down 1.2 percentage point from a year ago. The rate remains near its lowest point since 2006, Mace noted.

In independent living, the average occupancy level, at 90.2%, remained unchanged from the previous quarter and was down 0.4 percentage point from a year ago.

Seniors housing annual absorption was 2.4% as of the third quarter of 2018, down 0.1 percentage point from the second quarter and 0.1 percentage point from one year earlier.

The overall seniors housing annual inventory growth rate in the third quarter of 2018 was 3.4%, unchanged from the second quarter.

In majority assisted living properties, Mace said, annual inventory growth was 4.9%, up from 4.6% in the second quarter and equal to the record high 4.9% pace seen in the middle of 2017. “Demand continues to be relatively strong, with annual absorption of assisted living accelerating to 3.5% from 3.3%, which was the strongest pace since the second quarter of 2016,” she said.

Preliminary data on construction as a share of existing inventory for seniors housing was 6% in the third quarter of 2018 and was 1.1 percentage points below its recent high of 7.1% in the fourth quarter of 2017, according to NIC.

Seniors housing construction starts within the 31 primary markets during the third quarter of 2018 preliminarily totaled 2,349 units, including 905 independent living units and 1,444 assisted living units. On a preliminary, four-quarter basis, starts totaled 18,025 units. Construction starts data often are revised retrospectively in subsequent quarters as additional information becomes available, NIC said.

The average rate of seniors housing’s annual asking rent growth was 2.9% during the third quarter of 2018, up 0.2 percentage point from the previous quarter and down from a recent high of 3.8% in the fourth quarter of 2016.

“Rent growth has been less than wage growth for the past six quarters,” Mace said. “With today’s tight labor markets, upward pressure on wages is likely to continue, which will put pressure on some operators’ ability to grow net operating income.” Labor expenses amount to 60% of expenses for many operators, she said.

In assisted living, Mace said, same store asking rent growth was 2.6% in the third quarter, down 10 basis points from the second quarter. “Meanwhile, changes in average hourly earnings for assisted living workers show average hourly earnings up 4.2% for assisted living employees as of the second quarter of 2018,” she said, citing data from the U.S. Bureau of Labor Statistics. “Together, these data points show the pressure operators may be having as expense growth has been pressured higher, while rent growth has been easing.”

Rent growth, as with other factors, varies by region and operator, however, Mace said. “Among NIC’s primary markets, the top-ranked metropolitan areas for year-over-year rent growth were Portland, OR (5.1%); San Jose, CA; Seattle; and San Francisco,” she said. “Poorest rent growth was in Dallas, Kansas City, Cleveland and Atlanta. Many of these same markets have some of the lowest occupancy rates in the nation as well.”