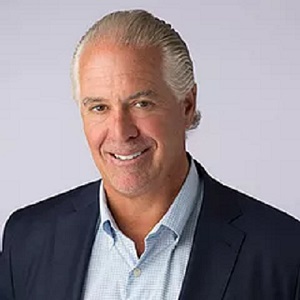

With a franchise of “fantastic” operating partners, Omega Healthcare Investors CEO Taylor Pickett said Tuesday that he expects to see the company’s investment in senior living “climb over time.”

Senior housing communities comprise approximately one-fifth of the Hunt Valley, MD-based real estate investment trust’s portfolio, Pickett said during a second-quarter earnings call. Along with supporting current operators, he said he expects the company to continue expanding its investments in its senior housing portfolio.

At the end of the first quarter, Omega’s senior housing portfolio represented a $2.2 billion investment, with all senior housing properties in triple-net leases. Including the recently acquired 24 Brookdale Senior Living communities, the company’s overall senior housing investment consists of 155 assisted living, independent living and memory care communities in the United States and the United Kingdom.

Since Maplewood Senior Living’s flagship property, Inspir Carnegie Hill in Manhattan, opened its doors in March, lease-up momentum has been “solid,” Chief Corporate Development Officer Steven Insoft said. The pandemic, however, poses challenges to senior living operators, including increased costs, managing COVID-positive residents, and meaningful, practical limitations on move-ins, he added.

Private-pay senior housing operators, Insoft said, have not seen the level of pandemic funding support that the federal government has provided to skilled nursing providers. That fact, along with other pandemic-related challenges, led to census erosion early in the pandemic, with second-quarter 2020 census hitting a low of 80.4%.

But, Insoft said, the company’s senior housing portfolio has seen small, measured occupancy improvements in the second quarter of 2021. The portfolio returned to an occupancy rate of 87.6% in June.

“Rising vaccination rates are a critical step toward restoring occupancy and performance,” Insoft said. “While we remain constructive about the prospects of senior housing, the COVID outbreak has warranted a far more selective approach to development. While we make further progress on our ongoing developments, we continue to work with our operators on strategic reinvestment in our existing assets.”

Omega invested $31.1 million in the second quarter in new construction and strategic reinvestment — $19.5 million was predominantly related to active construction projects, with the remaining $11.6 million related to its ongoing portfolio capital expenditure reinvestment program.

Pointing out favorable demographics, Pickett said. “We remain hopeful the federal government and states will provide additional near-term support for the skilled nursing facility industry and assisted living industry as we work to overcome the ongoing challenges from the pandemic.”