(Credit: Vertigo3d / Getty Images)

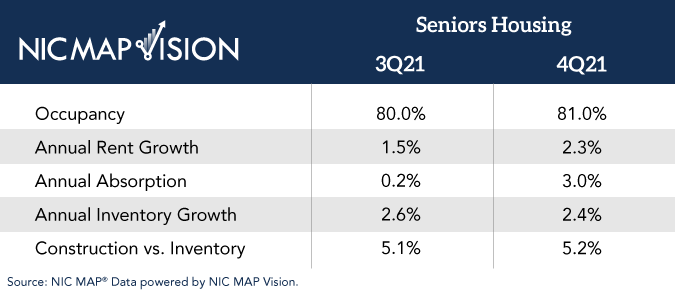

Senior living (independent living and assisted living combined) occupancy increased for the second consecutive quarter, rising to 81% in the fourth quarter of 2021, according to NIC MAP data released Thursday afternoon.

Occupancy increased 1 percentage point from the third quarter and 2.3 percentage points from a pandemic low of 78.7% in the second quarter. National Investment Center for Seniors Housing & Care Chief Economist Beth Burnham Mace said that although fourth-quarter occupancy typically is negatively affected by seasonal flu, the data do not appear to show any significant effect on occupancy from the COVID-19 delta variant. The impact from the omicron variant may not be known until first-quarter 2022 data are available.

Assisted living saw the largest increase in occupancy compared with independent living and skilled nursing properties, rising 1.4 percentage points in the fourth quarter. Assisted living occupancy increased to 78.3%, up from a pandemic low of 75.4% in the first quarter of 2021 but still below its pre-pandemic level of 84.9%.

Independent living occupancy increased to 83.6%, up from a pandemic low of 81.8% in the first quarter 2021. The sector remains below its pre-pandemic occupancy level of 89.7%. By comparison, skilled nursing occupancy increased from a pandemic low of 74.1% to 77.2% in the first quarter of 2021, but it also remains below its pre-pandemic 86.6% level.

San Jose, CA (86%), San Francisco and Boston (both 85.2%) saw the highest senior living occupancy rates among the 31 metropolitan markets that encompass NIC MAP’s primary markets. Houston (74.8%), Atlanta (77.9%) and Cleveland (77%) had the lowest occupancy rates.

“The data suggest that infection and safety protocols put in place during the first phase of the pandemic are keeping residents safe and driving continued move-ins into the properties by new residents,” Mace said in a statement. “These conditions, as well as relatively limited near-term inventory growth, should continue to help senior housing bounce back from pandemic-related occupancy losses.”

As McKnight’s Senior Living reported earlier this week, NIC President and CEO Brian Jurutka said that occupancy levels may not return to pre-pandemic levels nationally until late 2028 if absorption follows historical trends. Operators may need to pass along some pandemic-related expense increases to private-pay consumers during the recovery, he added.

Pent-up demand, increased supply and slow construction starts in 2020 contributed to occupancy increases in the second half of 2021, according to the NIC experts.

Demand increased by 21,029 units in NIC MAP’s primary markets in the third and fourth quarters of 2021, the strongest two-quarter unit increase since what is now known as NIC MAP Vision began reporting data in 2005. Conversely, inventory showed the smallest two-quarter unit count increase since 2015, growing by 6,687 units in the same timeframe.

Construction activity remained subdued, which NIC experts said supports continued moderate gains in inventory growth. Data showed a slight quarterly uptick in construction — 35,340 units in the fourth quarter — the weakest pace since 2015.

Rental rates increased by 2.3% across NIC MAP’s primary markets, partially attributed to higher operating and overhead costs. NIC reported that 67% of respondents to its Wave 35 Executive Survey Insights from December supported higher wages to address staff shortages, but the organization acknowledged that longer term staffing solutions are needed.

“Labor is the “No. 1, No. 2 and No. 3 top issue right now,” Jurutka recently told McKnight’s Senior Living.

Increased costs due to labor shortfalls and supply chain issues “will likely have to be absorbed into the operating budget,” he said, citing an ongoing need for personal protective equipment and infection control supplies. “These may, over time, be offset by savings through the adoption of technology, changing in staffing models or other operational efficiencies,” he added.

“Competition for workers is fierce and is pressuring wage growth, which, along with other escalating costs, has contributed to strained operating margins,” NIC Chief Operating Officer Chuck Harry said. “So, despite the markets’ still relatively low occupancy levels in general, operators effectively have managed to push rates upward in light of the increased operating costs.”

Visit the NIC website to see the market fundamentals report.