A senior living and care sector update from investment specialty banker Ziegler revealed a viable new opportunity for providers and insights into the pandemic’s impact on vaccination rates, move-ins and growth plans.

CARES Act update

The $1.9 trillion stimulus package expanded eligibility of the Paycheck Protection Program for larger nonprofit organizations.

“That is a great opportunity if you were a multi-site provider with less than 500 employees per individual campus but more than 500 employees total,” Managing Director Tommy Brewer said. The deadline to apply is March 31, but a bill approved in the House and pending in the Senate extends that date to May 31.

The big news, Brewer said, is the Employee Retention Credit, which is a viable opportunity for many organizations with 500 full-time employees or less. While the program has been around since March 2020, it wasn’t until December, when changes were made to the program through the Taxpayer Certainty and Disaster Tax Relief Act, that it became a great option for senior living providers.

The employee retention credit is a refundable tax credit against certain employment taxes. The ERC was established by the Coronavirus Aid, Relief, and Economic Security Act to address organizations that have been materially impacted by COVID-19.

The change made late last year makes PPP loan recipients eligible for the credit, as well as organizations with 500 or fewer full-time employees.

ERC qualification requirements also changed. A decline in gross receipts dropped from a 50% requirement in 2020 to 20% in 2021.Businesses also had to be impacted by government mandates, with office closures or partial suspension of operations by government orders.

Brewer said there are a lot of questions as to whether life plan communities meet the government mandate requirement. He said it is a “meaningful enough program” that he encourages life plan communities to reach out to their accounting firms to determine eligibility.

COVID-19 update

Lisa McCracken, director of Ziegler Investment Banking, shared information from the March 2021 Ziegler CFO Hotline survey.

COVID-19 vaccination uptake among residents is about 92%, according to the 240 senior living operators who responded to the survey, while staff uptake lags at 62%. But McCracken said providers are beginning to see staff openness “turning the corner.”

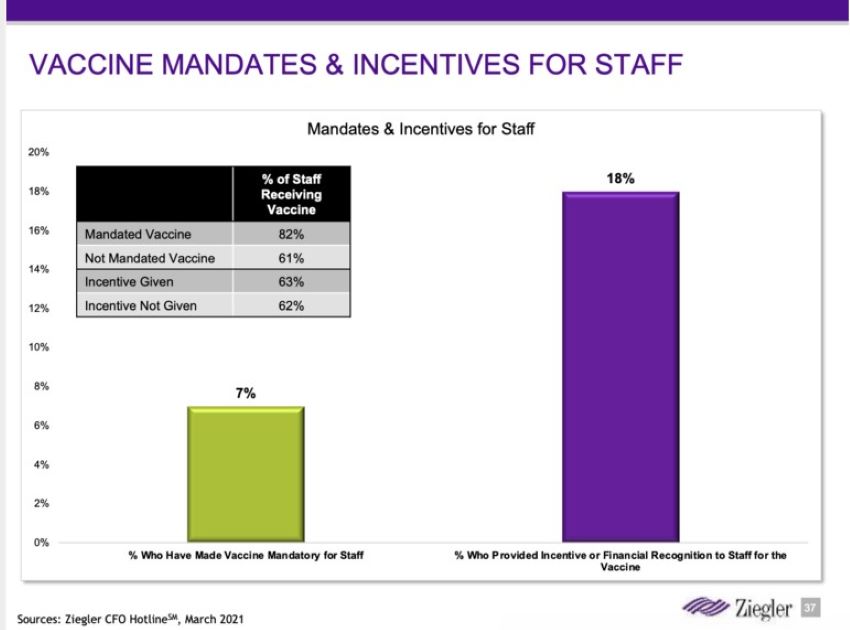

Very few operators are making vaccination mandatory for employees. Only one in 10 (7%) indicated they are making vaccination a condition of employment, and most of those are on the for-profit side. Providers mandating vaccination report 82% of staff are vaccinated, compared to a 61% staff vaccination rate among providers who did not mandate vaccination.

About 18% or providers indicated providing incentives or financial recognition to staff who take the vaccine. But McCracken said incentives are “not moving the needle a whole lot.” Providers offering incentives report a 63% staff vaccination rate, compared to a 62% vaccination rate reported by employers not offering any incentives.

“I’m not sure if we need to sweeten the pot with incentives or if it’s more around education,” McCracken said.

The CFO Hotline survey also looked at the impact of the vaccine rollout on sales, move-ins and inquiries. Only 8% reported significant positive momentum in this area due to the vaccine, 21% reported a moderate positive impact, 34% reported a slight impact and 38% reporting no increased momentum.

The pandemic also impacted not-for-profit senior living growth plans. McCracken compared responses from early March 2020 prior to the pandemic, August 2020 and March 2021.

Unit expansion dropped a bit, year over year, as did new community development, while affiliation and acquisitions were similar to a year ago. HCBS, however, showed a doubling in interest over the past year.

“Multi-site providers had more aggressive growth plans, particularly around affiliation, acquisitions, and even new community development,” McCracken said.