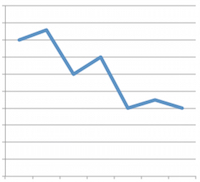

Twenty-two of the 31 markets tracked by the National Investment Center for Seniors Housing and Care had senior living community occupancy rates that were lower in the first quarter than year-earlier levels, NIC Chief Economist Beth Burnham Mace wrote in a blog posted Wednesday on the organization’s website.

The biggest loser was Detroit, she said. There, occupancy was down 360 basis points to 87.3%. St. Louis, Phoenix, Houston and Washington DC, also saw relatively big decreases, Mace said.

Seven markets had higher occupancy rates in the first quarter than a year ago, however. Portland, OR, saw the biggest improvement, Mace said. There, occupancy increased by 1.7 percentage points to 93%.

In 15 markets, the occupancy rate in the first quarter was higher than the primary market average, Mace wrote. The highest-performing markets included San Jose (95.1%) and Baltimore, Portland, Sacramento, Pittsburgh and Seattle (all 91%).

“At the other end of the spectrum are San Antonio, with an occupancy of 78.3%, followed by Houston, Atlanta Dallas, Las Vegas and Kansas City, all with occupancy rates below 85%,” Mace wrote.

Read Mace’s additional insights about first-quarter data here.