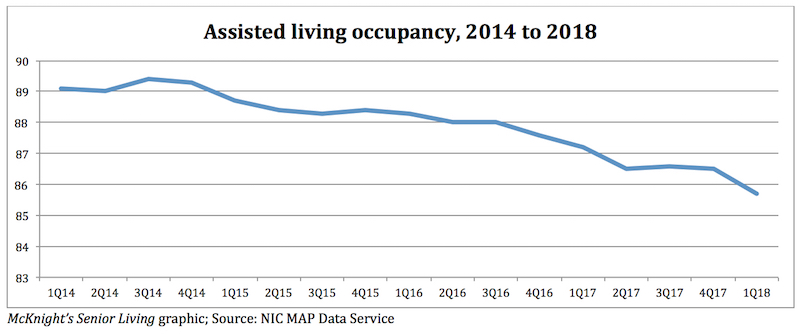

Assisted living occupancy reached a record low in the first quarter of 2018, according to data released Thursday by the National Investment Center for Seniors Housing & Care.

Occupancy in assisted living hit 85.7% during the quarter, down 0.7 percentage points from the fourth quarter and down 1.3 percentage points from year-earlier levels, according to information from the NIC MAP Data Service. (See the chart below for a graphic depiction of assisted living occupancy since 2014.)

“The quarterly decline in the occupancy rate for assisted living stemmed from a marked slowdown in first quarter absorption as well as less inventory growth,” Beth Burnham Mace, chief economist at NIC, said in a statement. “Winter weather typically causes a slowdown in both inventory growth and demand in the first quarter.”

A “particularly harsh” flu season also may have affected leasing due to quarantines, Mace said.

A “particularly harsh” flu season also may have affected leasing due to quarantines, Mace said.

Indeed, leaders of Brookdale Senior Living and real estate investment trusts HCP, National Health Investors, Senior Housing Properties Trust, Ventas and Welltower all mentioned occupancy challenges related to this year’s flu season in their most recent earnings calls. Capital Senior Living executives in February discussed the company’s first national public health initiative, an effort to try to better protect residents from the effects of influenza. CEO Larry Cohen said it resulted in “significant reductions in infections, hospitalizations and deaths nationwide” due to the virus.

The second quarter may see an increase in move-ins now that cases of the flu have peaked, Mace said.

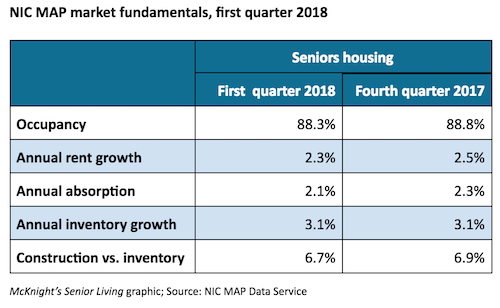

Overall, average seniors living occupancy fell to a six-year low of 88.3% in the first quarter, down 0.5 percentage points from the previous quarter and down 0.9 percentage points from year-earlier levels. This rate put senior living occupancy 1.4 percentage points above its cyclical low of 86.9% reached during the first quarter of 2010 and 1.9 percentage points below its most recent high of 90.2% in the fourth quarter of 2014, NIC said.

Overall, average seniors living occupancy fell to a six-year low of 88.3% in the first quarter, down 0.5 percentage points from the previous quarter and down 0.9 percentage points from year-earlier levels. This rate put senior living occupancy 1.4 percentage points above its cyclical low of 86.9% reached during the first quarter of 2010 and 1.9 percentage points below its most recent high of 90.2% in the fourth quarter of 2014, NIC said.

Independent living occupancy was the bright spot for the quarter, averaging 90.3%, but even that rate was down 0.4 percentage points from the previous quarter and down 0.6 percentage points from year-earlier levels.

Other first-quarter overall seniors housing data points shared by NIC:

- Annual absorption: 2.1%, down 0.2 percentage points from the fourth quarter of 2017 and down 0.4 percentage points from one year earlier.

- Annual inventory growth rate: 3.1%, unchanged from the fourth quarter.

- Construction as a share of existing inventory: 6.7%, which is 0.3 percentage points below the recent high of 7% in the third quarter of 2016, according to preliminary data.

- Construction starts: A total of 3,832 units within the 31 primary markets, including 2,373 independent living units and 1,459 assisted living units. On a preliminary four-quarter basis, starts totaled 22,087 units. Construction starts data often are revised retrospectively in subsequent quarters as additional information becomes available, NIC said.

- Annual asking rent growth: The average rate was 2.3%, down 0.2 percentage points from the previous quarter and down from a recent high of 3.7% in the fourth quarter of 2016. For comparison purposes, labor expense growth, as measured by the annual change in assisted living average hourly earnings, was 5% in the fourth quarter, according to the Bureau of Labor Statistics.

“There remains a wide range of inventory growth rates across the primary markets, as five of the top 31 metropolitan markets alone accounted for 35% — more than one-third — of the seniors housing units that came online during the past four quarters,” Chuck Harry, NIC’s chief of research and analytics, said in a statement. “That represented annual inventory growth rates of 5.5% or greater within each of those five markets, with the Houston metropolitan market again having registered the highest rate at 8%, or two-and-a-half times that of the aggregate primary markets. During those same four quarters, five other metropolitan markets saw annual inventory growth of less than 0.25%.”