Sen. Susan Collins (R-ME) said she is hoping for the passage of a bill that she and Sen. Claire McCaskill (D-MO) introduced last month, which would fast-track approval by the Food and Drug Administration of certain generic medications, “especially those that could compete with decades-old drugs that are vulnerable to the abusive pricing we have seen from Valeant and certain other companies.”

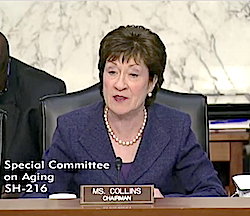

Valeant Pharmaceuticals International and its pricing practices related to four of its drugs — Syprine, Cuprimine, Nitropress and Isuprel — were the focus of an April 27 hearing of the Senate Special Committee on Aging, which Collins chairs and McCaskill is the ranking member. “These drugs had been affordable and easy to get for decades, but after Valeant acquired them, their prices went through the roof,” Collins said in prepared remarks.

The price of vasodilator Nitropress, for instance, has increased 310% since Valeant purchased it from Marathon Pharmaceuticals in 2015; the cost of blood pressure medication Isuprel, also acquired in 2015 from Marathon, has increased 720%; the price of Wilson disease drug Syprine has increased almost 3,200%; and Cuprimine, another Wilson disease drug, acquired through Valeant’s purchase of Aton Pharma in 2010, has increased almost 6,000% in price, Collins said. Nitropress costs $880 per 2-ml vial, Isuprel is $17,901 for 10 5-ml vials, and Cuprimine is $26,188 for 100 capsules, McCaskill said.

“We can find nothing to explain these dramatic price increases beyond Valeant’s desire to take advantage of monopoly drugs,” Collins said. “Its price-gouging strategy appears to be based on careful study of the FDA approval process. The company knows it often takes years before generic competitors can clear the hurdles imposed by that process to enter the market and to compete. During that period, Valeant exploits its de facto monopoly.”

Such pricing affects individuals as well as the country, McCaskill said. “It’s using patients as hostages. It’s immoral. It hurts real people,” she said. “It makes Americans very, very angry. In case you haven’t noticed, that has real ramifications in our political process and could lead to an instability of our government, our economy and our standing in the world.”

Problems for Medicare beneficiaries

One witness at the hearing, Berna Heyman, detailed her experience as a Medicare beneficiary with Wilson disease, a rare genetic disorder of copper processing that is fatal if not diagnosed. Heyman was being treated for the disorder with Syprine.

“Valeant purchased the drug in 2010 and began increasing prices,” she said. “My co-pay for Syprine was under $700 per year until 2013. By 2014, my projected copay exceeded $10,000 per year, with my insurance paying over $260,000.”

Access to appropriate treatment for the disease is especially problematic for Medicare beneficiaries, testified Frederick K. Askari, M.D. PhD, an associate professor and director of the Wilson Disease Center Of Excellence at the University of Michigan. An available patient assistance program is “time-consuming and frustrating” to navigate and difficult for individuals with the disease who also have neurologic conditions, he added.

“I am not here to cast blame on the entire drug industry,” Askari said. “Ethical pharmaceutical companies do support research, which provides new and improved treatments for diseases. …One should not confuse companies which institute sudden and dramatic price increases on longstanding, critical drugs with those which are truly developing new ones. There is an enormous human cost associated with these practices. I urge Congress to work diligently to arrive at policies that will protect patients, while maintaining incentive for new lifesaving therapies.”

Valeant board member, CEO testify

Valeant spent 3% of its revenue in 2015 on research and development, McCaskill said, but witness William A. Ackman, founder and CEO of investment firm Pershing Square Capital Management and a member of the Valeant board, said that “pharma companies should only invest capital in R&D programs on which they expect to earn a return in excess of their cost of capital.”

Nonetheless, he said, “Valeant has been appropriately criticized for substantially raising the prices of certain off-patent prescription drugs suddenly and without apparent justification. These issues are worthy of inquiry. As a recent member of Valeant’s board, I am committed to ensuring that this approach to drug pricing is never repeated at Valeant.”

In highly anticipated testimony, J. Michael Pearson, CEO of Valeant since 2008, told the hearing audience that he is proud that the company launched new drugs, invested in R&D and improved patient access to medications in new ways during his tenure. “But we have also made mistakes, including those that bring me here today,” he said. “In particular, the company was too aggressive — and I, as its leader, was too aggressive — in pursuing price increases on certain drugs. Let me state plainly that it was a mistake to pursue, and in hindsight I regret pursuing, transactions where a central premise was a planned increase in the prices of the medicines, such as our acquisition of Nitropress and Isuprel from Marathon Pharmaceuticals.”

In response to government and public concerns about drug prices, Pearson said, Valeant has created a volume-based price rebate program for hospitals using Nitropress and Isuprel. The company also has launched a consumer savings program with Walgreens, he said, that in part will provide an average 10% list price reduction for a majority of the company’s branded dermatology, ophthalmology and women’s health products, as well as up to a 95% price reduction on certain branded products for which a generic alternative exists. The company has 1,800 products, Pearson said.

On Monday, Valeant announced that Joseph C. Papa will replace Pearson as CEO in early May, at which time Pearson will leave the company. Papa was chairman and CEO of Perrigo Company, which develops, manufactures and distributes over-the-counter and prescription pharmaceuticals.

“Media outlets are reporting that Valeant’s new CEO may have built a mini-Valeant at his old company, raising the price of one generic drug by 300% since 2011,” McCaskill said during the hearing. “As far as turning over a new leaf goes, I remain skeptical.”