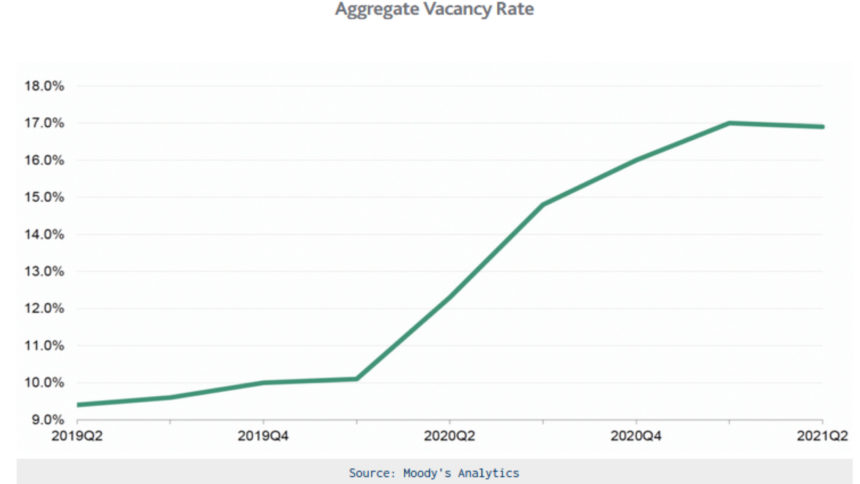

Demand for senior living and care is ticking upward, Moody’s economist Lu Chen wrote in a recent report. The combined national vacancy rate across long-term care property types, she said, trended downward in the second quarter of 2021 for the first time in seven quarters of continuous growth.

Vacancy rates remain high compared with pre-pandemic years. At 16.9% in the second quarter, however, overall vacancy across the continuum was 10 basis points (0.1%) below its peak of 17% earlier this year.

“It may be too early to say the stress has bottomed out, especially given the recent resurgence of the virus, but second quarter data did prompt a bit of optimism,” Chen wrote.

Memory care communities showed a vacancy decrease of 8.8%, ending the quarter at 19.9% vacant. Assisted living communities and skilled nursing facilities vacancies rose 6.9% over the same period, to 18.2% and 16.5%, respectively, whereas the vacancy rate at independent living communities increased 6.1% from 9.5% pre-pandemic, to 15.9%, in the second quarter.

New construction continues to lag moving into the second half of the year, with just a 0.23% increase nationally, which is 62 basis points (0.62%) below its peak at 0.85% at the beginning of 2019. The second quarter of 2021 saw 2,500 fewer senior housing units delivered with only 7,300 units coming online. The 2,500 units are 2,800 units fewer than in the second quarter of 2020, Chen said, and 13,000 fewer than the same quarter in 2019. Of the total, 68.4% of the new inventory was constructed and 29.5% were independent living communities.

“As a result of the weakness in sector fundamentals since the public health crisis, extended slowdown of new facilities coming to market is consistent with the increase in investors’ [sic] caution,” Chen wrote.