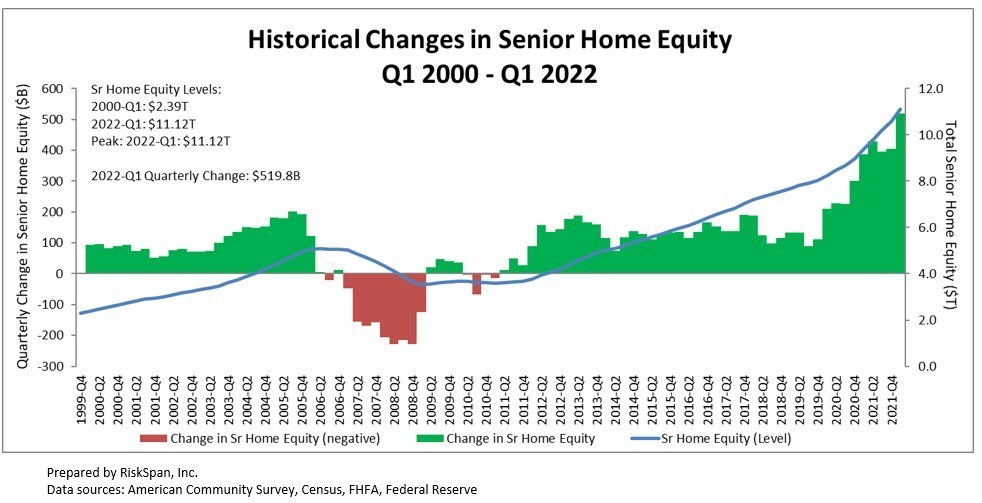

Homeowners aged 62 or more years increased their home equity by the first quarter of 2022 by 4.9%, to a record $11.12 trillion, from the fourth quarter of 2021, according to the latest quarterly release from the National Reverse Mortgage Lenders Association, published Tuesday. That’s a difference of $520 billion.

The NRMLA/RiskSpan Reverse Mortgage Market Index has reached an all-time high representing the time since the index was first published in 2000.

In the first quarter, the index rose to 388.83. The increase in older homeowners’ wealth mainly was driven by an estimated 4.4%, or $563 billion, increase in home values, offset by a 2.06%, or $43 billion, increase in senior-held mortgage debt, according to the authors.

Some older adults are using reverse mortgages to finance their moves to senior living communities. The most common form of reverse mortgage, according to experts, is the home equity conversion mortgage, the only one insured by the federal government. To date, according to NRMLA , more than 1.21 million households have used an Federal Housing Administration-insured reverse mortgage.

Older adults pay no income on the money they borrow from their home’s equity, certified financial planner Joel Johnson noted in a column for Forbes, and that income can be used for monthly cash flow to support healthcare and living needs.