A bill that raises the minimum age at which people are required to withdraw funds from their retirement accounts was signed into law in late December as part of a spending package that also increased funding for Alzheimer’s research.

Senior living advocates believe that the bipartisan Setting Every Community Up for Retirement Enhancement (SECURE) Act will result in older adults having more money to pay for long-term services and supports.

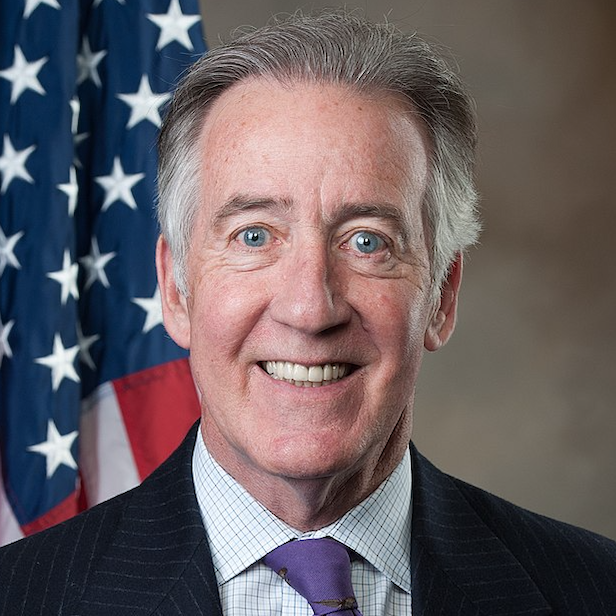

“The legislation closes loopholes and makes it easier for small business employees, home care workers and long-term part-time workers to save for retirement,” Rep. Richard Neal (D-MA) said in May when the House of Representatives passed it. Neal, chairman of the Ways and Means Committee, had introduced the legislation, which the Senate received June 3.

The act, among other things, changes the minimum distribution age from 70 1/2 to 72.

“The average age in assisted living is 85. We don’t know how much people have in their IRAs, but whatever you have, it will continue to grow from 70 1/2 to 72,” Argentum Chief Operating Officer Maribeth Bersani previously told McKnight’s Senior Living. “And then it just gives you that much more money that you can have when you need it for your long-term services and supports,” she added.

Argentum has been working to educate members of Congress and others about changing lifestyles and retirement security for years, Bersani said.

The act, she said in May, “really demonstrates that Congress is thinking about how Americans are aging differently. They are finally recognizing that people are living longer, they’re working longer, and they’re probably going to incur greater costs for long-term services and supports.”