“You cannot be successful today offering plain vanilla assisted living. In order for operators to be successful, they’re going to have to supply more and more diversity of product.”

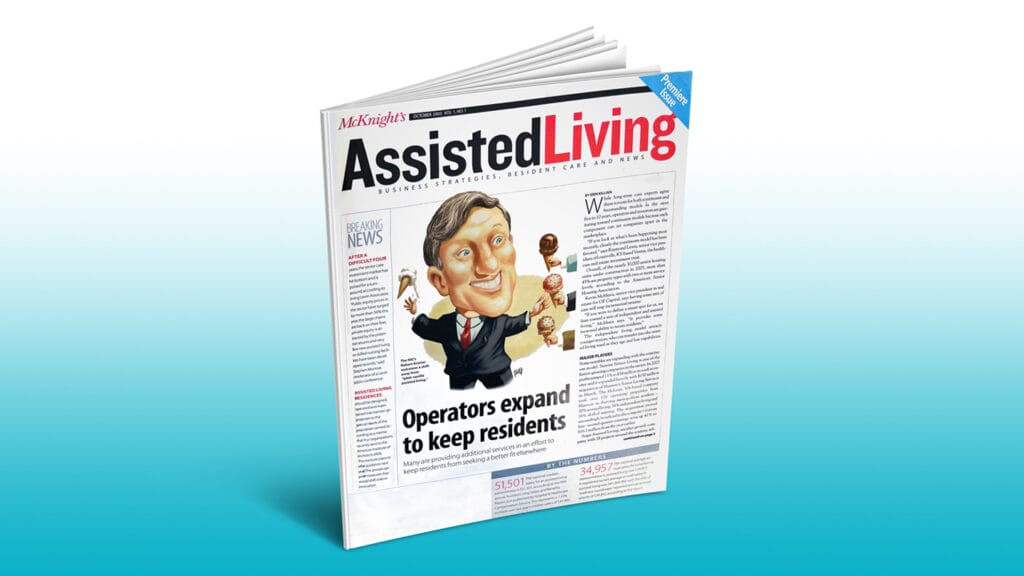

Those words of wisdom were shared by Robert G. Kramer in the very first issue of the print magazine of the media brand known today as McKnight’s Senior Living, in October 2003. A cartoon image of Kramer appeared on the cover, showing him tossing a vanilla ice cream cone while looking at other ice cream flavor options.

Many things have changed in the past 20 years.

In 2003, McKnight’s Senior Living was known as McKnight’s Assisted Living.

At the time, Kramer was president of an organization he founded named the National Investment Center for Seniors Housing and Care Industries. Today, he is a strategic adviser to the organization, now known by a slightly shorter moniker, the National Investment Center for Seniors Housing & Care. Kramer also is the founder of think tank Nexus Insights, which soon will merge with the new Aging Innovation Collaborative of the Milken Institute’s Center for the Future of Aging thanks to $3 million in funding from NIC.

Yes, things have changed. But Kramer still has many words of wisdom to share.

In 2023, he said, “I would say it’s diversity of product, and it’s also customization and personalization of product” that senior living operators now need to be successful.

A focus on living, not just care

That customization and personalization is warranted not only in price points, amenities, care plans and proactive management of chronic conditions, “but also in how we are customizing and personalizing engagement, which is actually key to healthy longevity,” Kramer said. “What I mean by that is not just having a care focus, but having a living focus.”

The product segmentation within the industry that was starting to be evident in 2003 in the relatively new stand-alone memory care communities operated by Silverado is now further manifesting in several ways — for instance, in high-end urban communities, intergenerational/multigenerational communities, active adult communities and offerings to appeal to middle-income individuals. Another change over the years, Kramer said, is that many continuing care retirement/life plan communities, which traditionally focused primarily on independent living and skilled nursing, have added assisted living and memory care, and “many are getting rid of skilled nursing, at least on campus,” due to staffing and regulatory costs and concerns.

Consumer needs, wants have changed

But at the heart of everything, from an operator standpoint, is an industry seeking to anticipate and respond to the needs and wants of an aging population, and those needs and wants have changed over the years. Kramer pointed out the shifting acuity levels in various settings that see some people who used to receive care in hospital units now cared for in SNFs, residents in assisted living today resembling the skilled nursing residents of a decade or two ago, and the independent living population of the present looking like the assisted living population of the past.

The new kids on the block, active adult communities, in many cases are becoming the independent living communities of yesteryear, enabling operators to “capture people sooner” and “creating enormous interest from investors and also from consumers who are not looking for care-driven settings and want a lifestyle type of setting,” he said.

In fact, in addition to addressing residents’ health-related needs, Kramer said, operators’ focus should be on “helping people discover and connect with their life’s purpose,” which will “make us a more aspirational setting rather than what we’re in danger of becoming with the public, a setting to avoid” due to a perception that senior living and care is a “continuum of decline.”

Providers have a six- to seven-year window before the oldest members of what Kramer referred to as the “Boom X” generation — which includes the baby boomers but also the older members of Gen X — start thinking in earnest about their next living arrangements. But the industry already knows that they don’t want what their parents wanted, Kramer said.

“They’re going to radically change our industry, which I think is exciting,” he said.

“This new generation is not looking for end-stage living,” he added. “They want something much more, and if you haven’t made the investments in technology and thought through how you’re going to deliver healthcare on-site but also provide that customized, personalized lifestyle that people are looking for, you’re going to find that the market is not anywhere near as big as you thought it was.”

Room for many flavors

In 2023, just as in 2003, room exists for many flavors of serving the needs of older adults, Kramer said, including not just next-generation residential senior living and care settings but also home care for people who want to remain in their homes, roommate-matching services for people who want to live “Golden Girls” style, and more.

“The demands and needs are going to be so great that we need to have all of the options,” he said. “It’s not either/or. It’s not this against that. The demands that are going to be there for affordable lifestyle options and for care are going to overwhelm the senior housing and care sector.”

As for federal regulation of assisted living? It was a topic of discussion in the 2003 pages of McKnight’s Assisted Living, but 20 years later, Kramer said he believes that the government’s “desire to invest the money to set up a federal regulatory apparatus is still going to be lacking,” although “there will be a lot of noise” about it.

“I do believe that we will deliver more and more healthcare where people live, which means in our communities, and much of that healthcare will be paid for by federal dollars — Medicare and, in some instances, Medicaid,” he said. “That’s going to mean more regulation, without question, but do I see an entire federal apparatus to regulate assisted living? I don’t see it in the near term because of the cost.”

But Kramer predicts increased state action.

“The things we see at the federal level now for skilled nursing, we’re going to see at the state level for assisted living and memory care,” he said. “The reality is that there are good operators and not-so-good operators. The more the industry can articulate and, in a sense, hold itself accountable for higher standards of care, the better off the industry will be, because we don’t want to go the direction of skilled nursing.”