A bipartisan coalition of 27 members of the House of Representatives is asking the Centers for Medicare and Medicaid Services to withdraw its proposed Medicaid Fiscal Accountability Regulation.

“Under the MFAR rule, states will have to repeal the exemptions from the nursing home provider bed tax that currently applies to continuing care retirement communities (CCRCs),” the representatives said in a Jan. 30 letter to CMS Administrator Seema Verma, which was shared Wednesday by LeadingAge. “CCRCs are likely to lose their exemption and be assessed additional state taxes, the costs of which could be passed on to CCRC residents, limiting access to and reducing the affordability of these communities.”

As an alternative to withdrawal, the members of Congress suggested that CMS “include language in any final rulemaking that makes clear that state provider tax exemptions and discounts for CCRCs comply with the final rule.”

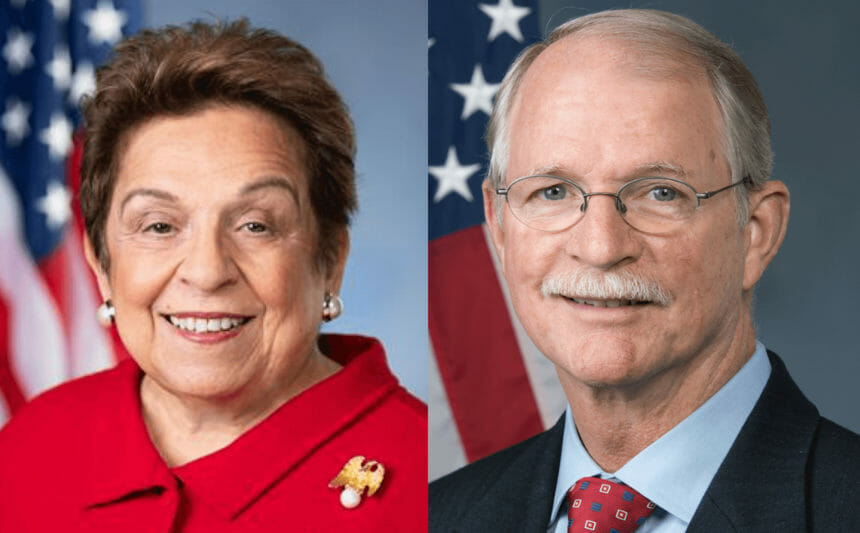

The House effort, led by signers Rep. Donna Shalala (D-FL) and Rep. John Rutherford (R-FL), aligns with sentiments of LeadingAge and the American Health Care Association / National Center for Assisted Living.

“Under the proposed MFAR rule, retirees across the country who plan carefully for long term care face increased out-of-pocket costs if CCRCs were to pass the cost to the consumer through heightened entrance fees or monthly fees,” the letter read. “While the exact cost of the new taxes would vary by state and by community, the price for seniors living in CCRCs in our communities could be significant to people who live on fixed incomes and have carefully planned for retirement costs, possibly adding several hundred dollars to a resident’s monthly expenses.”

In a Wednesday blog post, Verma said CMS had received more than 4,000 comments on the proposed regulation by the Feb. 1 deadline.

“We are reviewing them carefully, and we understand that potential changes in Medicaid financing and payment can have significant ripple effects at the local level,” she wrote.