Driven by inflation, bond financing has been slow and unstable during the first half of the year, according to specialty investment bank Ziegler.

After previously raising the short-term interest rate by 75 basis points, the Federal Reserve is expected to attempt to slow the market again by raising “its benchmark overnight interest rate by three-quarters of a percentage point to a target range of 2.25% to 2.50% at the end of a two-day policy meeting on Wednesday,” Reuters reported.

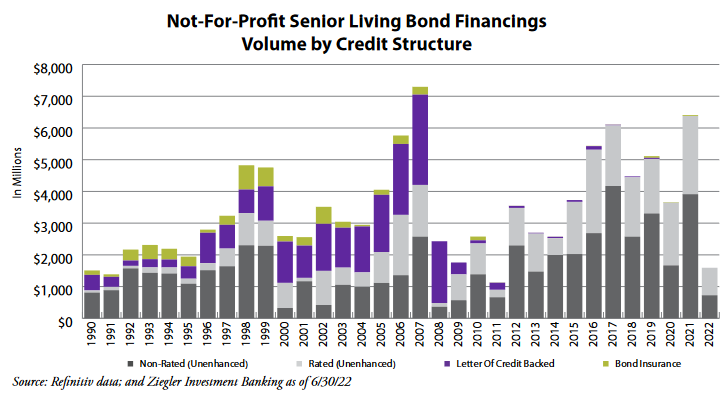

According to Ziegler, the issuance of senior living tax-exempt debt for the first half of 2022 was down approximately 9% from the same period last year. That compares with a change of 41% in 2021 over 2020, due to the pandemic. Total par volume was slightly below last year at nearly $1.6 billion through June 30, compared with nearly $1.8 billion for the same period in 2021, Ziegler said.

“Although the pandemic lingered into 2021, the first half showed borrower confidence as interest rates were still very low and senior living bond issuance closed 2021 with more than $6.4 billion,” Cathy Owen, vice president of senior living research at Ziegler, wrote in the latest issue of the Senior Living Finance Z-News e-newsletter.

The year started with borrowers taking advantage of lower interest rates carried over from the fourth quarter of 2021. That changed in mid-February, according to Owen, as rates began to rise and disrupt the market.

“Although a number of borrowers are still opting for bank direct purchase financings, as terms on these loans often extend to 10 years or more, this has slowed in 2021 and 2022 compared to prior years. The majority of these bank financings are for new money issuance, refundings, expansions and affiliations,” she said.

Much of the bond financing volume to date this year has been in the form of fixed-rate issues, as letter of credit-backed variable rate demand bonds have fallen out of favor since 2019, Owen said. Among fixed-rate issues, rated borrowers made up 55% of the volume in the first half of 2022. The share for rated issuance for the same period last year was 46%

Jessica Johnson, manager of healthcare banking for BOK Financial, previously predicted to the McKnight’s Business Daily that the volume of senior housing projects and acquisitions will slow down through the end of the year, then normalize somewhat in 2023, as buyers and sellers look for a “happy medium” in terms of pricing.

“As the Federal Reserve began to raise short-term rates in order to battle inflation, we have seen a slight improvement. With another rate increase on the horizon, it is hopeful that inflation will trend downward and municipal bonds will see greater demand,” Owen wrote.