WASHINGTON, DC — US senior living residents average more than a dozen chronic conditions each, and many residents use high-cost healthcare services, suggesting ways that operators can integrate care and housing to improve resident health and save money for the health system, according to a new analysis by NORC at the University of Chicago.

Results were delivered Wednesday at the National Investment Center for Seniors Housing & Care Fall Conference. NIC funded the study. Other sessions of the day highlighted senior living as an investment opportunity and the active adult segment.

Using NIC MAP Vision data to segment Medicare claims data, lead researcher Caroline Pearson, NORC senior vice president of healthcare strategy, and colleagues, found that assisted living residents average 14.4 chronic medical conditions, memory care residents average 13.8 conditions, independent living residents average 13.2 conditions, and CCRC residents average 12.2 conditions. Comparatively, nursing home residents average 16.3 chronic conditions.

“Senior housing providers have a tremendous opportunity to make a positive impact in the lives of residents by partnering with healthcare providers who are incentivized to deliver good health outcomes,” NIC President and CEO Brian Jurutka said. “It’s important for senior housing providers to understand how residents of their buildings interact with the healthcare ecosystem to better meet residents’ needs.”

The high prevalence of chronic conditions costs senior living residents overall $3,000 to $4,000 in out-of-pocket expenses annually, researchers said. It also drives average annual healthcare spending of $20,000 per resident, which is $4,000 more than the average annual Medicare beneficiary, they added.

In assisted living, residents are spending an average of $31,000 annually on healthcare costs, twice the average spent by Medicare beneficiaries overall, Pearson noted.

Acute inpatient spending accounts for 62% to 76% of resident healthcare spending, the study found. More than one-third of senior living residents have an inpatient stay or emergency department visit during the year, with most using prescription drugs. Spending on hospital inpatient care suggests an opportunity for operators to build programs aimed at reducing hospitalizations, researchers said.

Senior living residents also have considerable hospice and home health spending, they found. Assisted living residents, in particular, have higher spending for self-administered drugs, at $2,435 per resident, compared with $2,097 in memory care, $2,675 in independent living and $1,765 in CCRCs.

Despite the evidence, Jurutka said, communities are just beginning to understand the opportunity to closely integrate healthcare services with housing services.

Service line integration

NIC MAP Vision CEO Arick Morton said that healthcare companies — from Medicare Advantage plans to local hospice providers — are asking how they can serve senior living residents more effectively. Innovative providers, he said, are bringing together ancillary services — home health, hospice, primary care and diagnostics — in various combinations to increase volumes and margins.

The result, Morton said, is that providers deliver services more efficiently, residents receive coordinated care, and healthcare providers take profits and reinvest them into more resources available for residents.

Two-thirds have behavioral health diagnosis

Two-thirds of senior living residents have a behavioral health diagnosis, including major depression, according to the data. Conditions include ADHD, autism, schizophrenia and other psychotic disorders, mood disorders, anxiety disorders, personality disorders and substance use disorders.

By setting, the prevalence of behavioral health conditions among senior living residents is 73% in memory care, 71% in assisted living, 64% in independent living and 56% in CCRCs. Comparatively, the prevalence is 85% in nursing homes.

“This analysis shows that not all senior housing residents are equal when it comes to their health, and that behavioral health conditions are increasingly common,” Pearson said. “As calls for mental health support for all people living in America increase, stakeholders should consider the mental and behavioral health support that seniors, in particular, need.”

The study involved more than 250,000 senior living residents enrolled in traditional fee-for-service Medicare and more than 325,000 nursing home residents.

Another session: Active adult

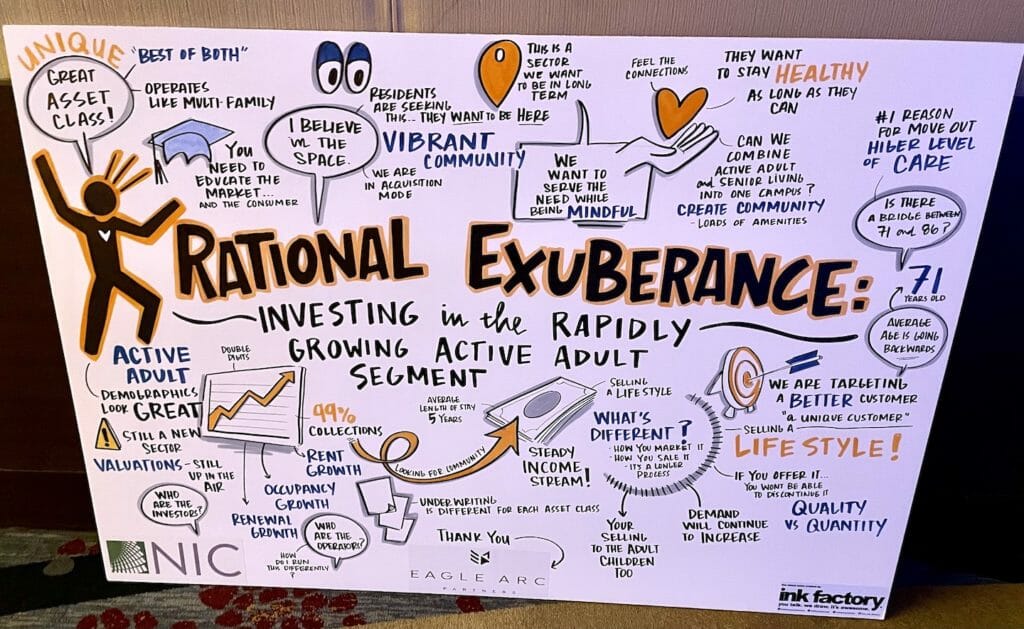

On the heels of the release of a NIC report defining the active adult property type, a Wednesday session at the conference focused on the growing segment.

“We all got into senior housing for the demographic wave, and this is the first part of it,” said one panelist, Newmark Vice Chairman Chad Lavender.

Operating an active adult community is similar to traditional multifamily properties, with no meals or care component, speakers said, whereas marketing them is more similar to traditional senior housing.

“They don’t care what your backsplash looks like” in the kitchen, although they want it to be nice, said Jackie Rhone, executive director of US real estate services – active adult, for Greystar. Instead, she said, prospective residents are attracted to the lifestyle.

Active adult residents, Lavender said, are “there for the community,” to be near their children or because a spouse died. The average length of stay is five years, he added, noting that unlike with traditional multifamily properties, active adult residents tend to stay, even with rate increases, because of the friendships and activities.

One potential challenge is that the market could become saturated, Rhone said, noting oversupply concerns in Dallas and other locations. Also, said Todd Goldberg, managing director of transactions for PGIM Real Estate, the sector’s relative newness means that it is unclear how it will perform in a downturn. But “so far, so good,” he said.

As for how independent living communities may be affected by the growth of the active adult segment, Mitchell Brown, principal, Senior Housing Consulting, said that a need still will exist for a property type to serve those whose ages and needs fall between those of active adult residents in their 70s and those of senior living residents in their 80s. But the senior housing industry has “got to change,” he said.

Attendance up

Attendance at the conference, according to Jurutka, is 2,800 — 15% higher than last year — and 25% of attendees identify as either female / nonbinary or underrpresented.

The event lasts through Wednesday.